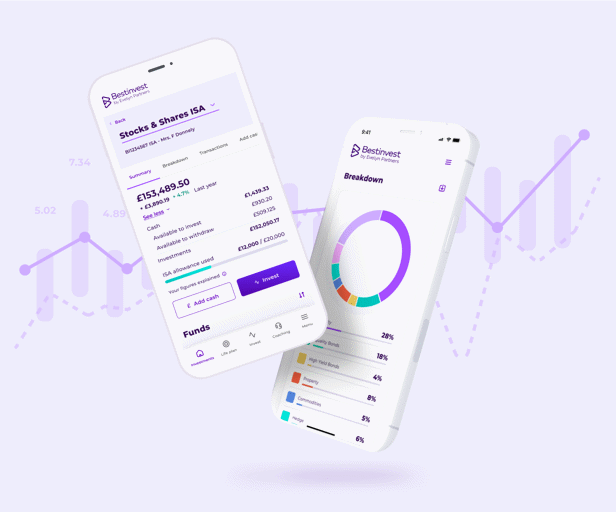

Stocks & Shares ISA and Junior ISA

You can now trade US shares online for free

What is a Stocks & Shares ISA?

A Stocks & Shares ISA (Individual Savings Account) is an account that gives you:

Easy investing

With a Stocks & Shares ISA, you can invest in a wide range of shares, funds, investment trusts and bonds.

No tax on any gains

You won’t pay tax on any gains you make, though ISA tax rules can change and their benefits depend on your circumstances.

ISA allowances

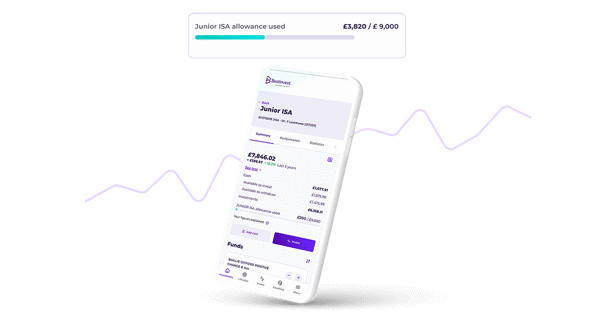

You can currently invest up to £20,000 into an ISA and up to £9,000 into a Junior ISA each tax year. Try our ISA calculator and stay on track the easy way.

Simple transfers

If you’re not happy with an ISA you hold elsewhere, you can easily transfer it as cash or investments.

Calculate what your ISA could be worth

Calculate what your ISA could be worth

Use our ISA calculator and stay on track the easy way.

Benefits of the Bestinvest Stocks & Shares ISA

If you choose to open an ISA with us, you can be sure of:

Award-winning service

We are incredibly proud to have won Best Customer Service at the 2021 Shares Awards, which are run by Shares Magazine.

Freedom to invest

You can pick your own investments or choose one of our Ready-made Portfolios

Value for money

Tiered service fees of 0.2% or less a year, no set-up fees and share dealing for just £4.95 per trade

Best Customer Service 2021 winner

Best Junior ISA 2022 winner

Bestinvest 2022 Stock & Share ISA Innovation winner

Choose your own investments

You can create your own ISA portfolio by choosing from more than 1,600 funds, UK shares, investment trusts and ETFs. Our search tool makes it easy to find individual investments, and you can use our free guides and articles if you need inspiration.

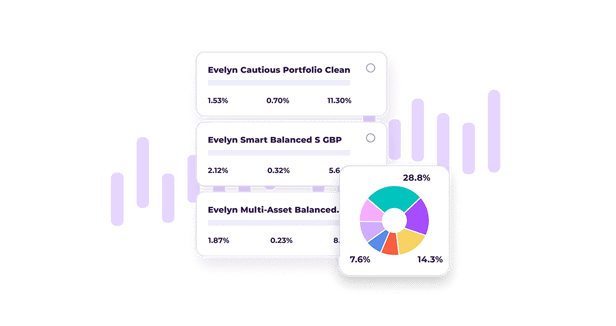

Ready-made Portfolios

For an effortless way to invest, you can pick from a range of Ready-made Portfolios that have been built by our experts. These are great for people who don’t have the time to invest or just feel more comfortable with professionals looking after their money.

ISAs for children

Our Junior ISAs work in exactly the same way as our adult ISAs, but for a child you can invest a maximum of £9,000 in this tax year. You can open a Junior ISA for a child under the age of 18 if you’re the parent or guardian and then anyone can contribute.

Our charges – Ready-made Portfolios and US shares

We have some of the lowest investment ISA account fees available. Our tiered annual account fees help you keep costs to a minimum.

Up to £250,000

0.2%

£250,000 - £500,000

0.2%

£500,000 - £1,000,000

0.1%

Over £1,000,000

No charge

Our charges – Other investments

You can also hold 3,000+ funds, shares and ETFs.

Up to £250,000

0.4%

£250,000 - £500,000

0.2%

£500,000 - £1,000,000

0.1%

Over £1,000,000

No charge

You don’t pay anything to open your ISA or buy funds, and share dealing costs just £4.95 per trade. Find out more

Why Bestinvest?

Simple

We make investing online as straightforward as it should be

Proven

We started Bestinvest in 1986 but our roots go back much further

Supportive

If you need help along the way, we’ve got you covered

Start thinking about tomorrow, today

Open an account and bring your goals forward.

Frequently asked questions

Why choose Bestinvest for your ISA?

An award-winning service, low-cost fees and a wide choice of investments make Bestinvest an obvious choice if you’re looking to invest in an ISA.

What is a flexible ISA?

A flexible ISA is a type of ISA that lets you withdraw money temporarily and pay it back within the same tax year without affecting your annual allowance. Our Stocks & Shares ISA is flexible but Junior ISAs are never flexible. Find out more about flexible ISAs

How can I withdraw money from my ISA

You can withdraw money from your Stocks & Shares ISA at any time. There's no charge, but there may be charges for selling some investments, depending on which you hold. Remember though that Stocks & Shares ISAs are designed for long-term investing so it’s best to keep money in your account if you can.

At what age can a child benefit from their Junior ISA?

As a parent or guardian, you can open a Junior ISA for a child aged up to 18. It is held in their name but they cannot manage the account until they reach 16. They can start to make withdrawals after their 18th birthday.

Need help with ISAs?

Book a free financial planning session with one of our coaches.

Browse our investment team’s favourite funds

Browse our team's favourite funds - download your free copy of The Best Funds™ List

Search and filter thousands of investments available through our Online Investment Service

Let the experts manage your investments by choosing one of our Ready-made Portfolios