US dollar depreciation and gold appreciation

The strong US dollar was a key feature of 2022’s financial markets. But could gold steal its spot as market vulnerabilities etch in?

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 23 Jan 20235 minute read

The strong US dollar has been a feature of financial markets in 2022. It has benefited from rising US interest rates, but also from its safe haven status in an uncertain environment. However, it has started to look more vulnerable, with a potential pause in the Federal Reserve’s (Fed) interest rate hiking cycle. Could gold step up to take its place?

Historically, the US dollar has tended to perform well during periods of market weakness, such as that seen in 2022. At the same time, the pound has tended to be weak through periods of uncertainty. This has been seen through the Global Financial Crisis, the Covid sell-off and the recent inflation shock, even ignoring the dramas of Trussonomics. While the outlook for markets in the year ahead is still uncertain, many of the challenges are well-understood and reflected in market valuations.

The reverberations of the strong US dollar have been felt throughout financial markets over the past 12 months. It has flattered the performance of US assets for international investors, but also boosted the UK’s US dollar-earning companies, helping returns for the UK stock market. The strong US dollar has also held back emerging markets and curbed earnings for some key US-based international companies such as Apple.

Any reversal in the strong US dollar is therefore important for sterling-based investors and for investment decision making more broadly. Some of the support for the US dollar is eroding. The rest of the world is catching up with the Federal Reserve on interest rates, for example, so the yield advantage to holding US dollars is weakening.

The US dollar is likely to see further weakness if the Fed pauses on interest rates in 2022 – as we expect. Inflation is coming down faster than predicted and, while the Fed is still talking tough, this may give it some flexibility to halt rate rises. That said, it is worth noting that Fed Chair, Jay Powell, continues to say interest rates will rise and go higher than markets currently expect, so there are some risks to this view. There are other factors which could contribute to a weaker US dollar. China has reopened its economy which could help boost global growth exerting pressure on the US dollar.

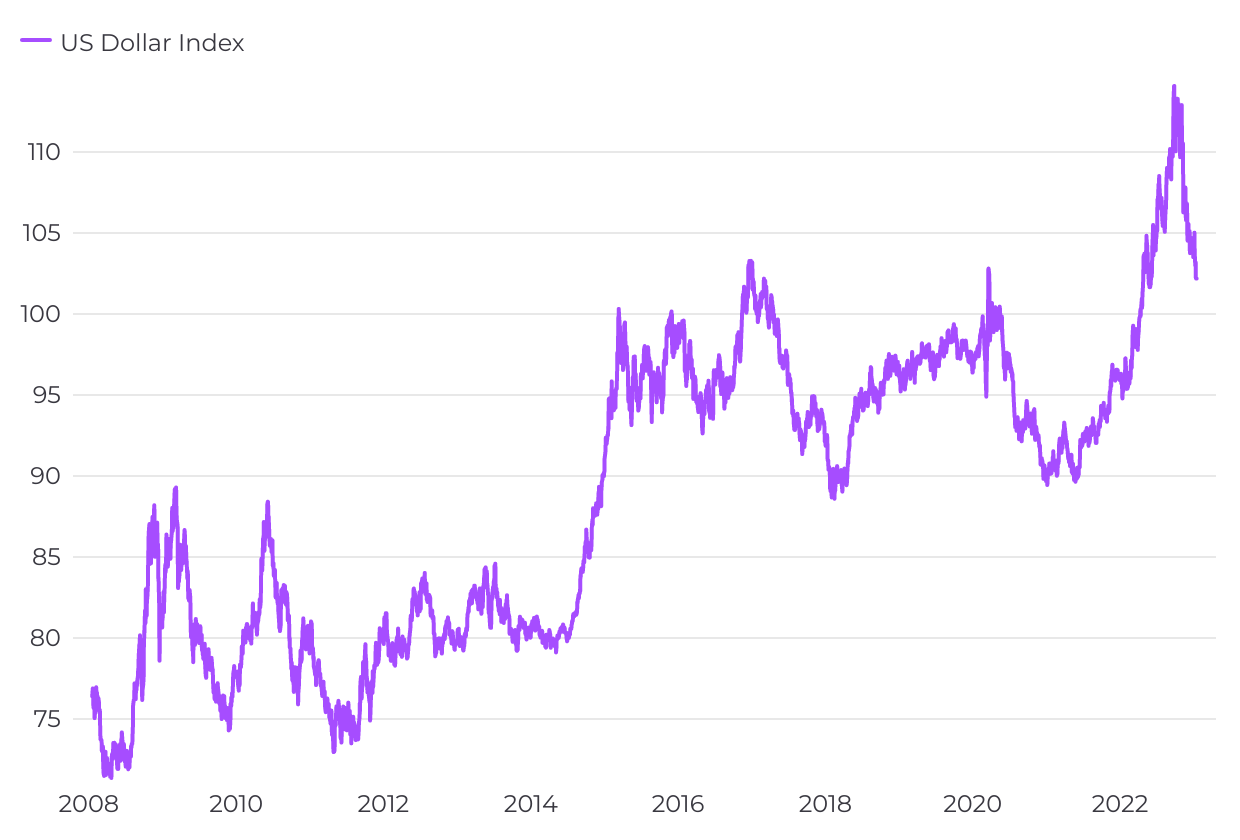

The US dollar has further to fall

US dollar performance versus global basket of currencies

Source: Refinitiv Datastream/Evelyn Partners. US Dollar Index. Data as at 17 Jan 2023. Past performance is not a guide to future performance.

Valuations

The US dollar has weakened from its highs of 2022, but still looks highly valued against most major currencies, particularly against sterling. Purchasing power parity, which compares the prices of the same goods in different countries' currencies, has historically been a good guide to the future performance of currencies. On this basis, the US dollar looks more expensive versus the pound than it has done since 1985. If sterling were to revert to its long-term average levels, it would need to appreciate by around 8%.

The private basic balance – a long-term measure of private money that includes trade and capital flows – has also been a guide to the relative valuation of individual currencies. It suggests a significant over-valuation for the US dollar. However, currency markets have largely overlooked it. If rates were to become less of an influence and capital flows more of an influence, sterling may appreciate.

The role of gold

It should have been a more difficult period for gold. Real government bond yields (real yields), which take into account the effects of inflation, tend to be a long-term driver of the gold price and since 2007 have accounted for around 85% of the variation in returns. With real yields rising, it should have exerted a drag on the gold price, but the price has proved extremely resilient amid difficult markets.

Over the past year, the gold price has decoupled from real yields. This is likely to be a result of rising demand from central banks, which is currently running at its highest level in over 50 years. Diminishing trust between the East and West may be a factor in this demand surge. The confiscation of Russian foreign reserves by the US has significantly undermined trust in using the US dollar as a safe haven.

From here, if the Fed pauses on interest rates, it may support the gold price further. Equally, if the US dollar continues to weaken, gold may be a beneficiary of some of those outflows. Even without a strong directional view on gold, it provides significant diversification, with zero long-term correlation to equities, so, in our opinion, merits a presence in a portfolio.

Is the end of the petrodollar in sight?

Volatile geopolitics has historically been a support for the US dollar, and this has certainly been true in 2022. However, over the longer term, it is possible to envisage this changing. The past 12 months have been pivotal in realigning global power and it is likely that many oil-producing nations (the Saudis and OPEC in particular) now see China as their largest customer rather than the US. Petrodollars are US dollars used to buy oil and through an agreement made in 1974 between the US and Saudi Arabia, which are recycled into investments – particularly US treasuries. A change in this relationship could impact the value of the US dollar. We could be seeing a generational shift to a scenario where geopolitical uncertainty leads to a weaker US dollar, not stronger.

This removes an important support for the US dollar and may help the gold price as investors look for an alternative safe haven. In our opinion, it is only a matter of time before the Chinese start to trade oil with Saudi Arabia in renminbi rather than US dollars. This weakens the value of petrodollars. Geopolitical shifts are likely to put incremental pressure on the US dollar over time. In this context, gold may assume a more important role.

None of these factors by themselves will break the US dollar’s dominance. However, cumulatively, they may start to change investors’ minds on the currency. If they do, the US dollar has a long way to fall given relative valuations. If momentum builds behind a weakening US dollar, it will have significant repercussions across financial markets. Gold may provide an important defence for investors.

Important information

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

The value of an investment may go down as well as up and you may get back less than you originally invested.

Past performance is not a guide to future performance.