Business as usual – why now is a good time to be invested

Political uncertainty and stock market volatility have both hit headlines consistently over the last few years, and we have heard from many clients who are concerned about committing their money to the stock market. However, we believe now is as good a time as any to be invested in the stock market. In this article we explain why.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Published on 14 Jun 20193 minute read

Investing is for the long term

During periods of volatility it’s important to remember that investing is for the long term. Generally the riskier the investment the longer you should be prepared to leave your money untouched, but as a rule of thumb it is a good idea to only invest money that you can leave for at least five years.

Here at Tilney a key part of our investment philosophy is to let time do the heavy lifting for us when it comes to generating investment returns. We base our investment decisions on the fundamentals rather than trying to time the markets or second-guess rises and falls.

Markets have a tendency to rise over time

Over time both stock markets and wider economies have a tendency to rise. This applies to everything from share prices and earnings to wages and the price of household goods.

Of course, there are ups and downs along the way. With long-term investing we can expect cycles – periods of falling prices followed by a recovery. And volatility is actually a sign of a healthy stock market – an unusually calm stock market can be a sign of complacency and problems on the horizon. We believe that a key to successful investing is being comfortable knowing that there will be falls as well as rises in the market.

Is this just a blip?

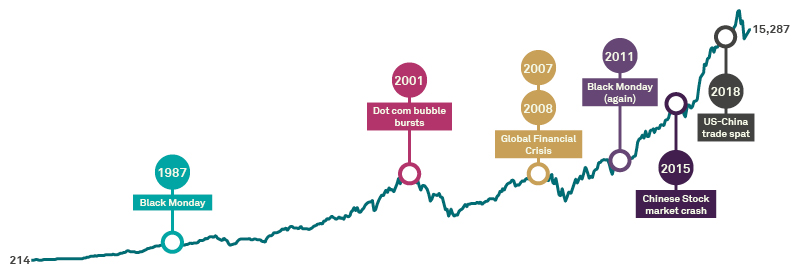

The below chart looks at the last 40 years of global stock market returns (according to the MSCI World index). We have pointed out a handful of stock market crashes and periods of extreme volatility – how many of them do you remember?

MSCI World index level from 1979 to 2019

Each of these crashes – represented by dips in the line – was unpleasant for investors at the time. And yet, when we look at the big picture we see that the stock market has recovered each time – the index level increased from 214 in January 1979 to 15,287 in January 2019. As the line rises, we see a return to profitability for those who stayed invested for the long term.

But of course, it can be difficult to keep this in perspective with today’s 24-hour newsflow and sensationalist headlines. We also need to bear in mind that past performance isn’t a reliable indicator of future performance.

Sentiment versus fundamentals

We should also consider the reasons behind the recent stock market volatility. Much of this can be attributed to sentiment – in other words, the general outlook and attitude of investors towards a particular country or stock market. The UK and emerging stock markets in particular have suffered from negative sentiment over the past few years – with Brexit uncertainty, the possibility of a Corbyn-led government and the US-China trade spat making investors feel uneasy.

It’s important to bear in mind that changes in sentiment are one of the key drivers of short-term returns. However, short-term changes are impossible to forecast consistently, and trying to time the markets can lead to locking in losses and missing out on gains. This is why at Tilney we ignore market noise. Instead we focus on the fundamentals, particularly earnings growth, valuations and the impact of monetary and fiscal policy. These are the key drivers of long-term returns and they are possible to forecast with a degree of accuracy.

The risk of holding cash

When stock markets are volatile the natural reaction is to move your money into cash. However, it is easy to forget that this comes with its own risks. Inflation can decimate the spending power of your cash over the long term as the price of goods steadily increases. In fact, if you had £1 in 1979 you would only have 20p of spending power in today’s money.

RPI inflation is currently at 2.7% and easy-access cash savings accounts aren’t currently paying more than 1.5% interest. So even though your bank balance will increase, by moving your money into cash you could actually lose money in real terms.

In conclusion

Although markets have been volatile and the future looks uncertain, we see no reason not to be invested in the stock market at the moment. We remain confident that good returns can be found for people who are comfortable investing for the long-term and riding out the ups and downs along the way.

It’s important to remember that any time spent out of the stock markets is a period of time potentially missing out on returns. As we have seen, these periods of strong performance tend to provide a positive overall return over the long term, even if it’s sometimes a bumpy ride along the way.

Important information

All chart data from Lipper for Investment Management, as at 31 January 2019.