July Market Pulse – economic growth recovers despite the resurgence of Covid-19 infections

Chris Godding looks at the challenges facing emerging markets, the reality of missing out and a potential light at the end of the tunnel for UK equities

Published on 24 Jul 202011 minute read

Written by Chris Godding

World equity markets have continued to recover despite the resurgence of Covid-19 infections in the Sunbelt states in the US and localised outbreaks in other countries emerging from lockdown. The supporting logic is that despite lower earnings expectations, lower interest rates justify or validate higher equity prices.

BCA Research, a global provider of independent investment research, make the case that, despite a nervous consumer and a looming fiscal cliff in the US as support packages roll off, equities will continue to rally. Economic growth is likely to continue to recover, while governments and central banks will maintain ultra-accommodative fiscal and monetary policies.

BCA Research also highlight the point made in the Pulse last month that there is a huge amount of cash sitting in money market funds and that institutional investors are broadly underweight equities. BCA call it the ‘reality of missing out’, or ROMO (rather than FOMO), and it reminds us that a paper loss only becomes a reality if you sell at the bottom.

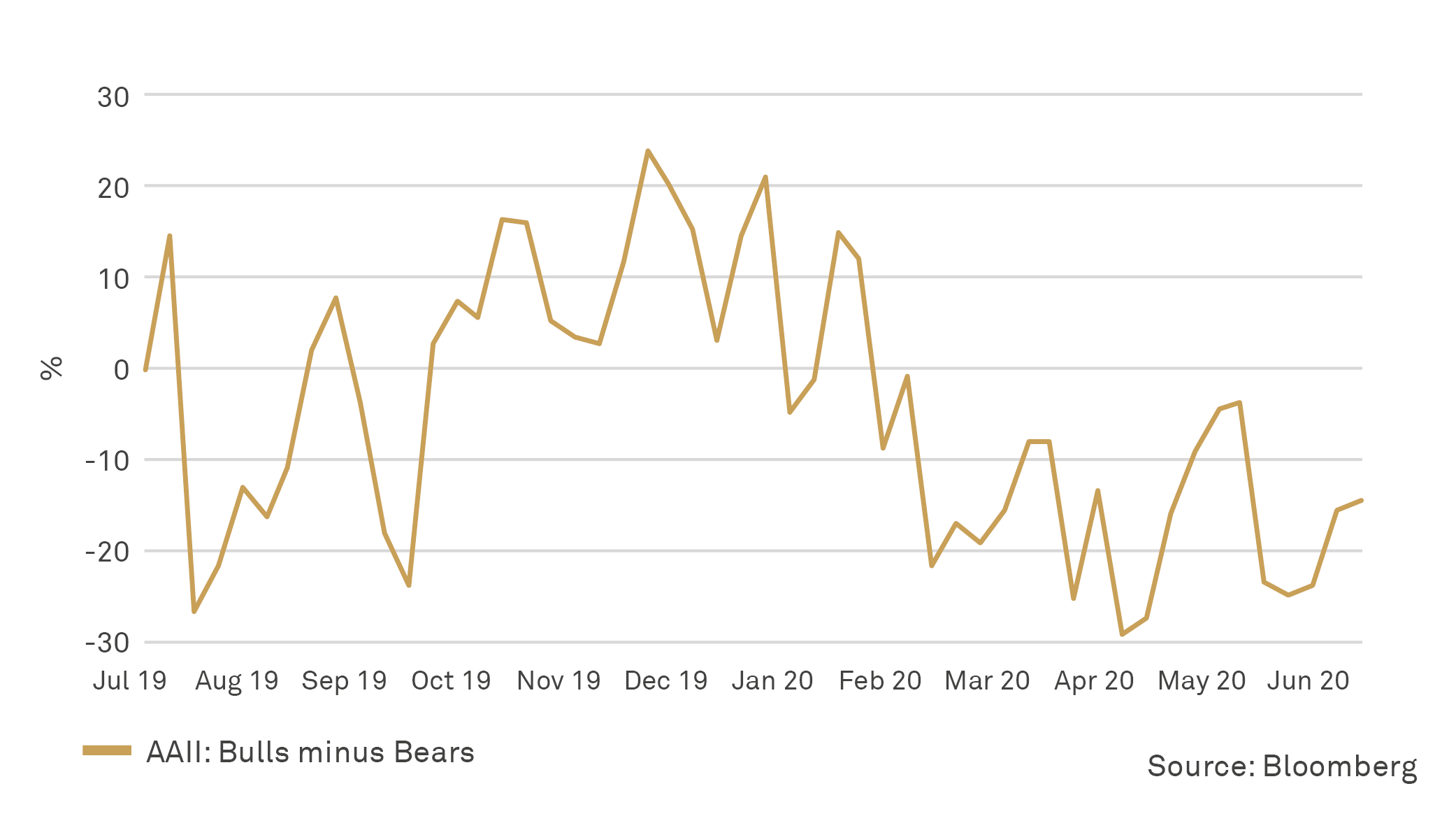

The American Association of Individual Investors (AAII) indicates that market bears exceed the bulls by 15%, which is near the low end of the range. There are also no signs of capitulation from the nervous bystanders just yet, which would be a sure sign of a top.

AAII: Bulls vs Bears

Best not to be too harsh on the bears, though, as there are legitimate reasons to be cautious and equity markets are unlikely to be a smooth ride; a lot of good news is in the price. We are only 5% away from our 2021 year-end target price for the MSCI World Index set in late March.

There is a mounting cost to the fiscal support packages and, similar to local councils here in the UK, state and local governments in the US are facing a severe cash crunch as revenues evaporate while social spending obligations increase. The lack of a co-ordinated lockdown strategy is prolonging the economic impact in the United States and an election in November is looming. Joe Biden has a healthy lead in the polls, which implies higher corporate taxes, but it still looks difficult for the democrats to take the Senate, which would imply policy paralysis – at least on the domestic front. G7 relations with China are fraught and, although Biden would probably not look to escalate a trade war any further, the risk of an acceleration in deglobalisation is a challenge for emerging markets.

Therefore, the bears may have another chance to buy in at lower prices but the pain endured over the last four months suggests the urge to ‘buy the dip’ will soften any short-term correction.

Emerging debate

In a recent research piece looking at the longer-term prospects for emerging markets (EM) in a post-Covid world, Barclays suggest that the Covid-19 crisis is not only likely to hasten existing structural challenges for emerging markets, but create new ones as well. The acceleration of deglobalisation and demand destruction in developed markets (DM) will, in their view, challenge the traditional EM growth model. Moreover, EM economies do not have the kind of policy firepower that DM countries have used to limit damage and ward off the long-term effects of the Covid shock. These growth challenges will lead to a deterioration in labour and productivity indicators and to slow capital accumulation in coming years.

Economies higher up the value chain and less reliant on labour-cost arbitrage are likely to fare better, but lower cross-border trade and labour mobility will probably dampen gains from greater specialisation and economies of scale. Covid-19 also poses particular risks in terms of healthcare and social cohesion for EM, with Barclays seeing a strong correlation between per capita income and economic resilience to new outbreaks. Countries with high inequality, ineffective government and a higher development index score are more likely to see more in the way of protests while the crisis has also caused massive deterioration in fiscal and debt profiles.

However, Barclays highlight that the negative impact is likely to be felt in varying degrees. ‘Frontier EMs’, which typically do not have deep local markets to finance large fiscal deficits, and ‘challenged EMs’, where existing fiscal problems would be exacerbated and may be tempted to issue more local currency debt, are the most exposed, while ‘advanced’, near-developed EMs, with manageable debt and financing profiles, are exhibiting greater resilience.

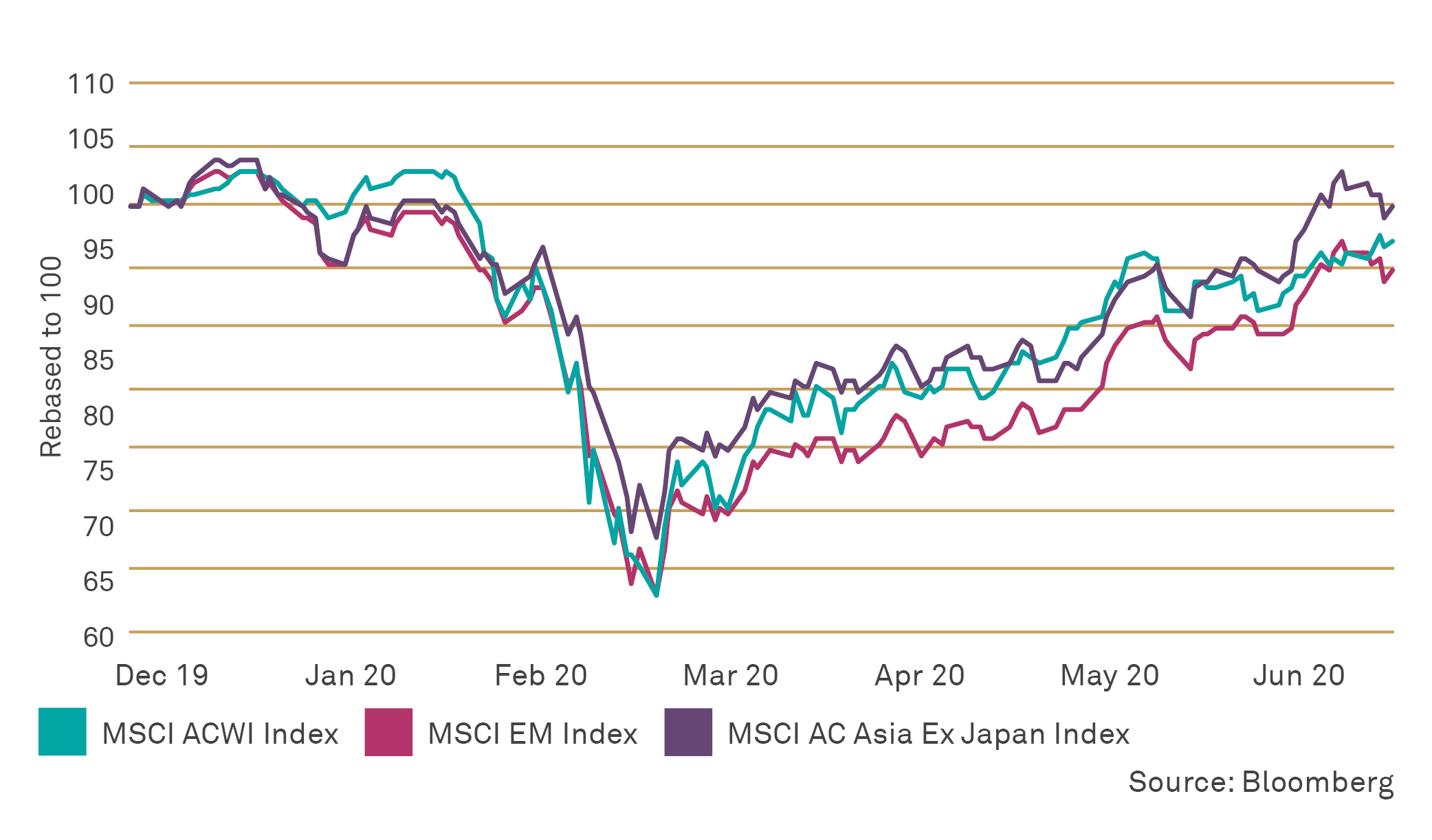

Year–to-date, the MSCI Asia Ex-Japan index has done better than both the MSCI World AC Index and the MSCI EM index, which suggests that investors class the region in the ‘advanced’ EM category. A robust response and a fairly quick recovery have helped, but the impact on international tourism is a major concern for many countries in the region.

Given the sacrifice and investment required by DM countries to undo 30 years of globalisation, it will be interesting to see if the structural fears are warranted.

MSCI Asia Ex-Japan is emerging stronger

In Avril Lavigne's words: I always get what I want

TS Lombard Research (TSL) see further upside for China in particular, noting that Beijing wants a steady bull market and it usually pays to follow what the State desires.

TSL interpret the message to be that the authorities “favour slow gains over a period of months with limited involvement of margin financing; the objective being to boost consumer sentiment and spending via wealth effects and to aid corporate funding by increasing the proportion of ‘direct financing’, lowering dependence on bank loans. With retail savings flowing into the stock market, property speculation will also fall”. TSL also emphasise that “President Xi Jinping certainly does not want a repeat of the boom-bust 2015 cycle, which almost broke the economy and the renminbi”.

The rapid 20% move in the Shanghai Composite index from mid-June was probably a little unsettling for the Politburo as a result. This illustrates the difficulty in controlling retail and institutional investors when given a green light. It also puts the People's Bank of China (PBoC) in a tough position, given that government refinancing and investment is vulnerable if a surging bull market makes it difficult to lower interest rates. Therefore, it is no surprise to see the recent targeted intervention to rein in speculation.

Officials in Beijing do not want to give investors a ‘one-way bet’ and will not tolerate higher short-term interest rates. The economy is in the early stage of building momentum, driven by a recovery in exports and property, plus a slow return of consumer demand, and the strategy is to keep things on an even keel. It will mean that China is set for 2% growth in 2020 and 8.5% in 2021, which is well ahead of DM and EM peers.

According to TSL, Beijing is “in control for now” and will stop any prospective bubble, but in all likelihood equities will end up at a higher equilibrium.

US or them

Apologies for the slight misspelling of the title of the 2004 song by The Cure Us or them, but it leads me into the dominant performance of the US stock market and the tech stocks in particular.

In previous editions, I have noted that equity valuations in growth stocks and technology were quite extreme but saw no real reason for the leadership to change while interest rates hover around zero.

However, we underestimated how strong the momentum would be and it would be fair to say that our ‘value trade’ in UK equities and underweight in the US has been wrong. However, even a broken clock is right twice a day and now we have good company in the form of Peter Berezin, Chief Global Strategist at BCA Research, and JP Morgan’s equity strategist and long-time UK bear Mislav Matejka.

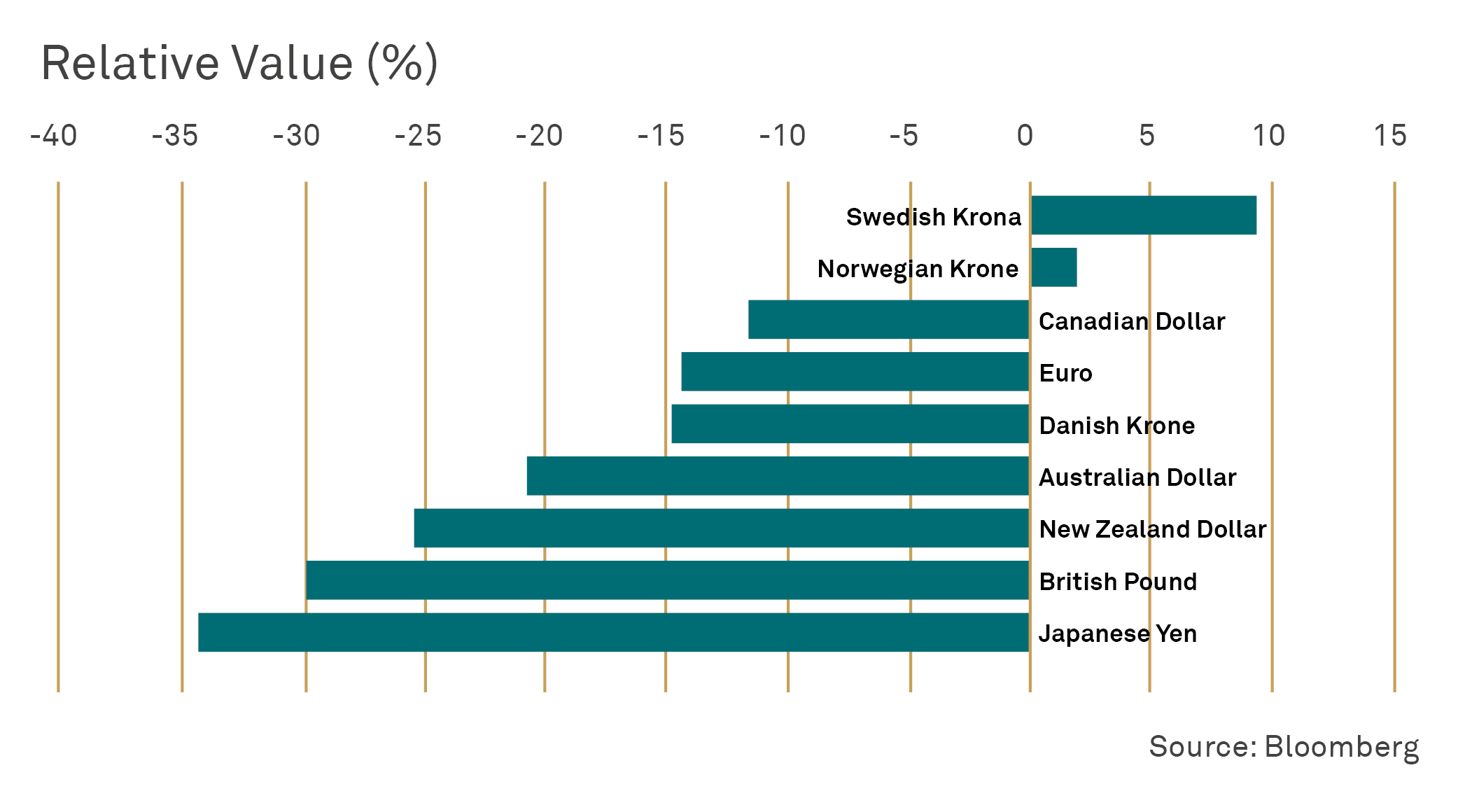

Berezin remains positive on stocks but sees the higher-risk premiums offered outside the US markets as the better option for the next 12 months. His assumptions are that a revival in global growth will favour cyclical stocks over defensives and that the US dollar will weaken as a counter-cyclical currency. He is concerned that by failing to control the virus, the US economy will be harder hit and the US dollar will suffer as the growth premium between the US and the rest of the world narrows. Thirdly, the interest rate differentials no longer favour the US dollar and, lastly, it is an expensive currency. This is illustrated by purchasing power indices such the Big Mac Index in the table below that, unsurprisingly, compares the prices of a Big Mac in different countries.

US dollar valuation – The “Big-Mac” index

In Berezin’s words, “the right trade over the past few years was to be long the US dollar and overweight US stocks. It is time to flip this trade and do the opposite”.

In the case of JP Morgan’s Matejka, the UK is finally off the naughty list after being the global laggard for five years – I wonder what started that!

The catalysts for the change in view begin with valuation, but there’s nothing new there. UK equities have been cheap for a while. However, we are at 20-year lows on a forward P/E basis. Matejka also points out that the UK has not responded to lower-bond yields nearly as much as it normally does and the gap now suggests that UK stocks will play catch-up and close the gap.

Matejka sees support from a weaker currency on the back of the FX research at JP Morgan, which implies that the significant undervaluation noted in the chart above will stay elevated or even widen. This should help the exporters, but Matejka also favours the domestic plays at the same time.

Our positive stance on the UK and non-US equities at the beginning of 2020 was based on a global economic recovery post the easing of monetary policy by the Federal Reserve in 2019, but Covid -19 rather spoilt that. The economic deep-freeze also benefitted the tech growth names as interest rates plunged and consumers binged on Netflix and Amazon. However, BNP Paribas points out that open interest in NASDAQ 100 stock index futures are now back at a 10-year high, which implies maximum tech bullishness and a fairly strong signal that it’s a good time to be a contrarian.

As the global economy recovers we believe that non-US equities are likely to out-perform. Thanks to Covid-19 we were wrong at the start of this year but now we have a pretty strong endorsement from two of the best people in the industry – misery loves company!

"The only function of economic forecasting is to make astrology look respectable", J.K. Galbraith

I am told that an untrained pilot who flies into a cloud will maintain control for about a minute before they become completely disorientated. At the peak of the market turmoil in March we were facing a similar fate as all our normal reference points disappeared.

We approached the problem with the assumption that granular forecasts were less reliable than broader estimates such as global GDP and we built a very rough outline of the earnings based on consensus estimates.

Using this estimate, our expected return from the MSCI World AC Index over the following 18 month came in at around 50% from the lows of March, which would take us back to the February peak of 580 and an attractive risk/reward.

As I mentioned previously, we are now just 5% short of that target and understandably more ambivalent regarding the prospects, but the ample liquidity support from fiscal and monetary policies suggests that we ride with the current momentum rather than join the ROMO crowd.

What concerns me in the longer term is unemployment and the permanent loss of income when fiscal support packages expire. A huge number of people, and not just those in retail, travel, leisure and entertainment, are at risk as the developed economies transition to a post-Covid world. I believe that the world will be investment-led rather than consumption-driven. Governments may raise taxation to stabilise deficits and ‘labour displacement’, rather than Covid-19, may be the real structural challenge to the market assumptions.

For the time being, a vaccine and a ‘V’ or ‘Nike-Tick’ recovery are the consensus and, until that changes, equities and gold are the logical beneficiaries.

If you have any questions about your investments or how Bestinvest can help, please contact us on 020 7189 2400 or book an investment checkup to speak to us.

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…