Russia-Ukraine conflict

Will markets take the strain from Ukraine?

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 24 Feb 202215 minute read

Key messages

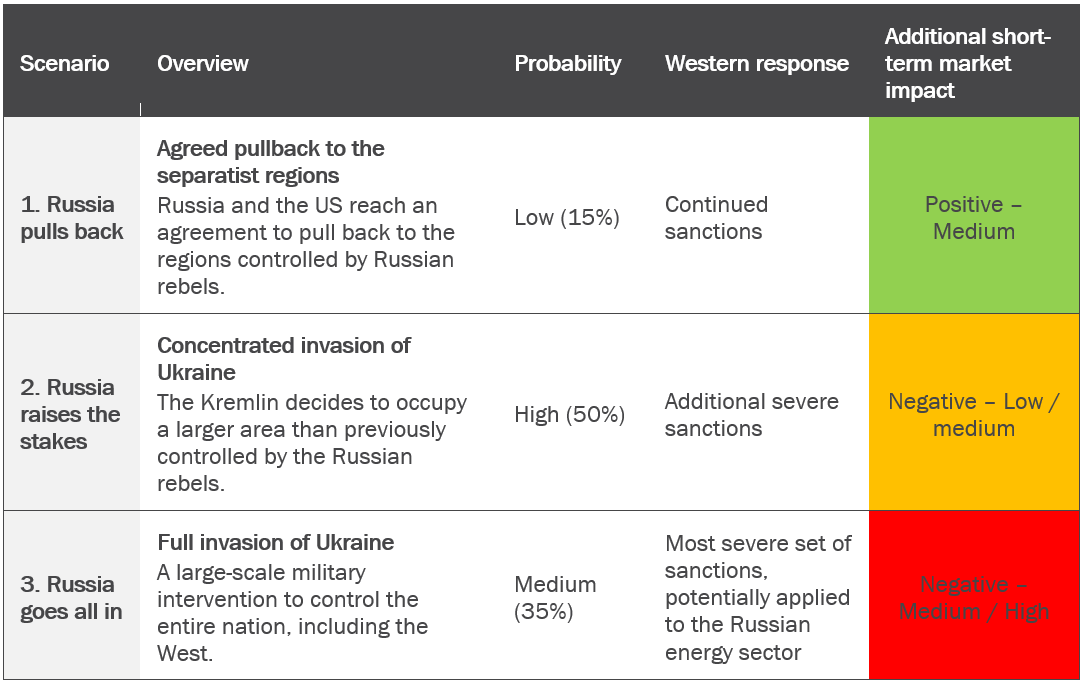

- On the 24 February the Russian President, Vladimir Putin, ordered a military invasion against Ukraine. To capture the range of plausible outcomes resulting from this, we identify three scenarios — ranging from a Russian pullback to separatist held areas to a large-scale military occupation of the whole nation. Our central scenario sees a limited invasion to control a larger territory

- With Russia responsible for around 11% of global oil exports, the invasion could present a risk to supply, which is already tight following low levels of investment. However, we expect the economic impact to be lower compared to previous oil shocks (e.g. 1970s). The Eurozone is most exposed given its closer economic linkages and dependency on Russia for natural gas, but we do not expect the invasion to trigger a deep recession

- If the price of oil stays close to $100 then its direct contribution to inflation will be disinflationary over Q1-Q3 2022. However, if the price increases to $130 inflation will increase over the coming quarters

- Historically, the market’s response to geopolitical events tends to be short-lived. Our analysis finds that, on average, losses resulting from geopolitical events are erased within one month

- Ultimately, the Russia-Ukraine situation is another problem for stock markets to digest at a time when they were already starting to look vulnerable from multi-decade high inflation and the removal of accommodative monetary policy. But we will continue to monitor the situation carefully and will adjust our positioning accordingly should we see a shift in the fundamental outlook. For now, considering the balance of probabilities as long-term investors, we favour maintaining current equity exposure

As tensions between Russia and Ukraine increased in recent weeks, Western leaders scrambled to reach a diplomatic agreement to avoid further escalation. Regrettably, this failed. In the early hours of 24 February 2022, the Russian President, Vladimir Putin, ordered an invasion of Ukraine. In this note we look at the potential scenarios that could unfold and what this could mean for markets.

Russia’s red lines are unacceptable to the West

At the heart of the dispute is NATO’s eastward expansion since the fall of the Soviet Union. While the West views NATO as a peace-keeping organisation, Putin sees a meaningful threat to Russian security.

To counter this perceived threat, Putin has issued three key demands to Western powers, marking his red lines in negotiations. First, he demanded that Ukraine should never be allowed to join NATO. Second, the organisation should halt its eastward expansion and roll back to its position in 1997. Third, NATO troops, strike missiles, and nuclear weapons should be withdrawn from Russia’s western border.

Although Western powers are unlikely to concede to these demands, it had brought them to the table for discussions. But as Russian troops roll into Ukraine, diplomacy is off the cards in the near term. The resulting impact on markets will depend on how Putin plays his hand and the Western response.

Geopolitical poker — what is Putin’s next move?

The intentions and actions of President Putin are notoriously difficult to predict. Indeed, despite repeated warnings by the Western intelligence agencies many market analysts did not expect the major military offensive that began on the 24 February. At the time of writing, military attacks have been launched from Ukraine’s northern border with Belarus, Crimea in the South and from Russia’s eastern border. This has had an immediate impact on markets, with the price of crude oil jumping above $100 and the Russian equity market falling sharply1. The key question is - what is Vladimir Putin’s end goal and how far will he go to achieve this?

To capture the broad range of plausible outcomes[i], we identify three scenarios. We don’t know how long this situation will last, but we do assign a high probability of this being a constant geopolitical risk through 2022. Investors should therefore be prepared for tensions to ebb and flow, with elevated levels of portfolio volatility as a result.

i Clearly, the assigned probabilities are subjective, and the relatively low probabilities assigned to each scenario highlight the fact that the current situation is highly uncertain.

Table 1: Possible scenarios for Russia’s next play

Source: Tilney Investment Management Services Limited, as at 24 February 2022

How will the Western alliance respond?

Scenario 1 considers an outcome where Russian military action remains concentrated in, and around, the disputed territories of Eastern Ukraine. The West would return its focus to diplomacy and the market impact would be relatively muted given that this event is already priced in. While unlikely at this stage, an agreement reached in a short time frame would be positive for markets.

But Scenarios 2 and 3, which consist of Russian forces entering and controlling a far larger share of Ukraine, would have a far greater impact (a tail risk is that Vladimir Putin looks to redraw the European map, drawing NATO into the conflict). Regrettably, these scenarios would have devastating social and economic consequences for Ukraine. Its economy is already suffering in the face of elevated uncertainty — significant capital flight has taken place and the yields available on Ukrainian government debt have spiked.

The consequences for Russia will depend on where Putin stops. New sanctions would undoubtedly hit Russian businesses and the broader economy harder than in 2014. These could include banning Russian firms from accessing US technology — this has proven particularly effective against Chinese tech firm Huawei, with the firm’s revenues down by 30% since similar measures were applied on its activities2. Boris Johnson has stated that his government will target Russian wealth held in UK-based shell companies in a move against Putin’s inner circle. The most severe options, which could occur under Scenario 2 or 3, are sanctioning Russia’s oil and gas exports and removing its access to the SWIFT global payments system. Sanctioning Russia’s energy sector would have significant consequences for Europe, however, countries do maintain strategic reserves to hedge against this type of risk, which should limit the impact.

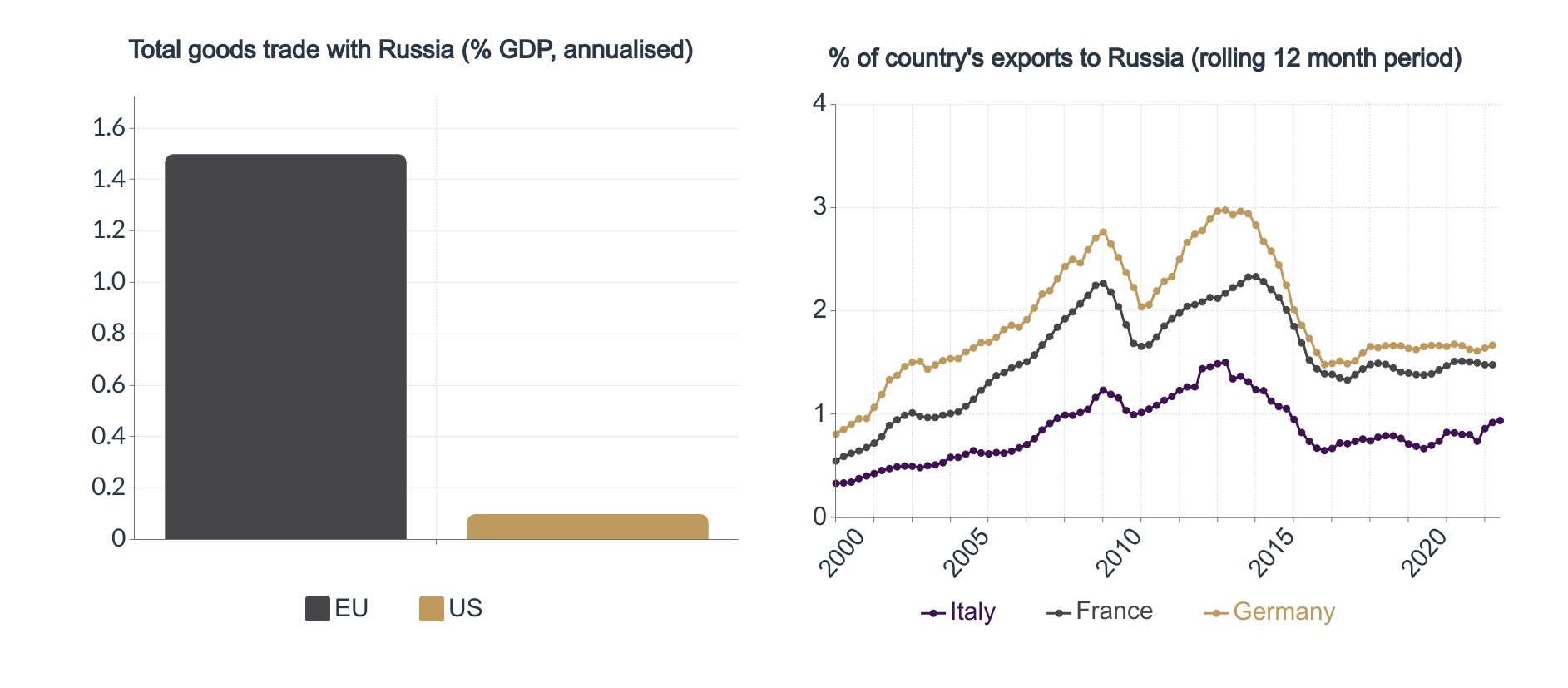

While the European economy is more exposed to Russia than the US (Figure 1), we expect the impact on non-energy trade to be manageable given its gradual decoupling from the Russian economy since 2014 (Figure 2).

Figure 1-2: Europe trades more with Russia but exports have declined since 2014

Source: IMF, Eurostat, BEA, Deutsche Bank, Refinitiv/ Tilney Investment Management Services Limited, data as at 23 February 2022

What does this mean for monetary policy?

As the Russian invasion progresses the Central Bank policy response will be crucial for markets. The European Central Bank (ECB) is more exposed given Europe’s closer economic relationship with Russia, particularly from an energy perspective. A conflict scenario that drives energy prices and inflation significantly higher would place pressure on the ECB to maintain its accommodative stance. While less exposed, US markets are already pricing a less aggressive tightening cycle. Markets suggest the likelihood of a Fed 50 bps hike in March has fallen and now expect 6 rate hikes by December 2022 rather than 73.

The impact on financial markets will primarily be driven by the energy channel

The 50% increase in the price of oil since May 2021 has led markets to forecast a peak in the first quarter of 2022. However, with Russia responsible for around 11% of global oil exports, a further escalation presents a major risk to supply, which is already tight following low levels of investment as we transition towards greener economies4. A shock to supply could come through Western sanctions placed on Russian exports, or Russia’s retaliation to sanctions. This will have a direct impact on purchasing power, investors’ risk appetite, and household/business confidence (Figure 3 below).

Figure 3: How an oil shock could impact the global economy

Source: Tilney Investment Management Services Limited

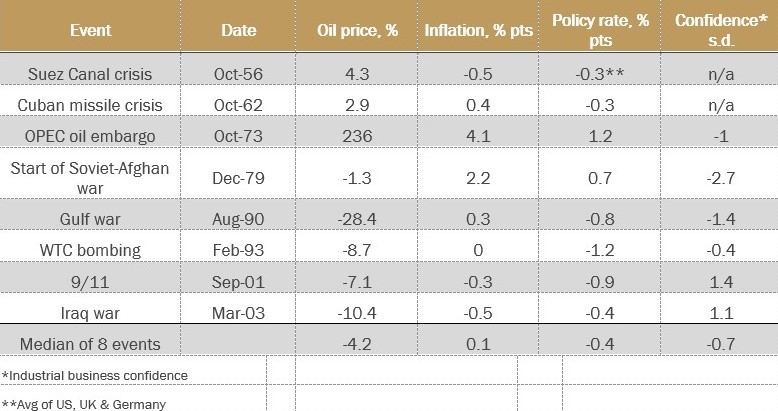

Previous oil supply shocks have had hugely negative impacts on growth, often tipping the global economy into recession. In particular, the 1973 oil shock stands out (Table 2) with oil prices doubling over six months, leading to higher inflation and a major global recession.

Table 2: G7 Average change in four macro variables 6-months after geopolitical or military events

Source: Capital Economics/ Tilney Investment Management Services Limited, data as at 23 February 2022

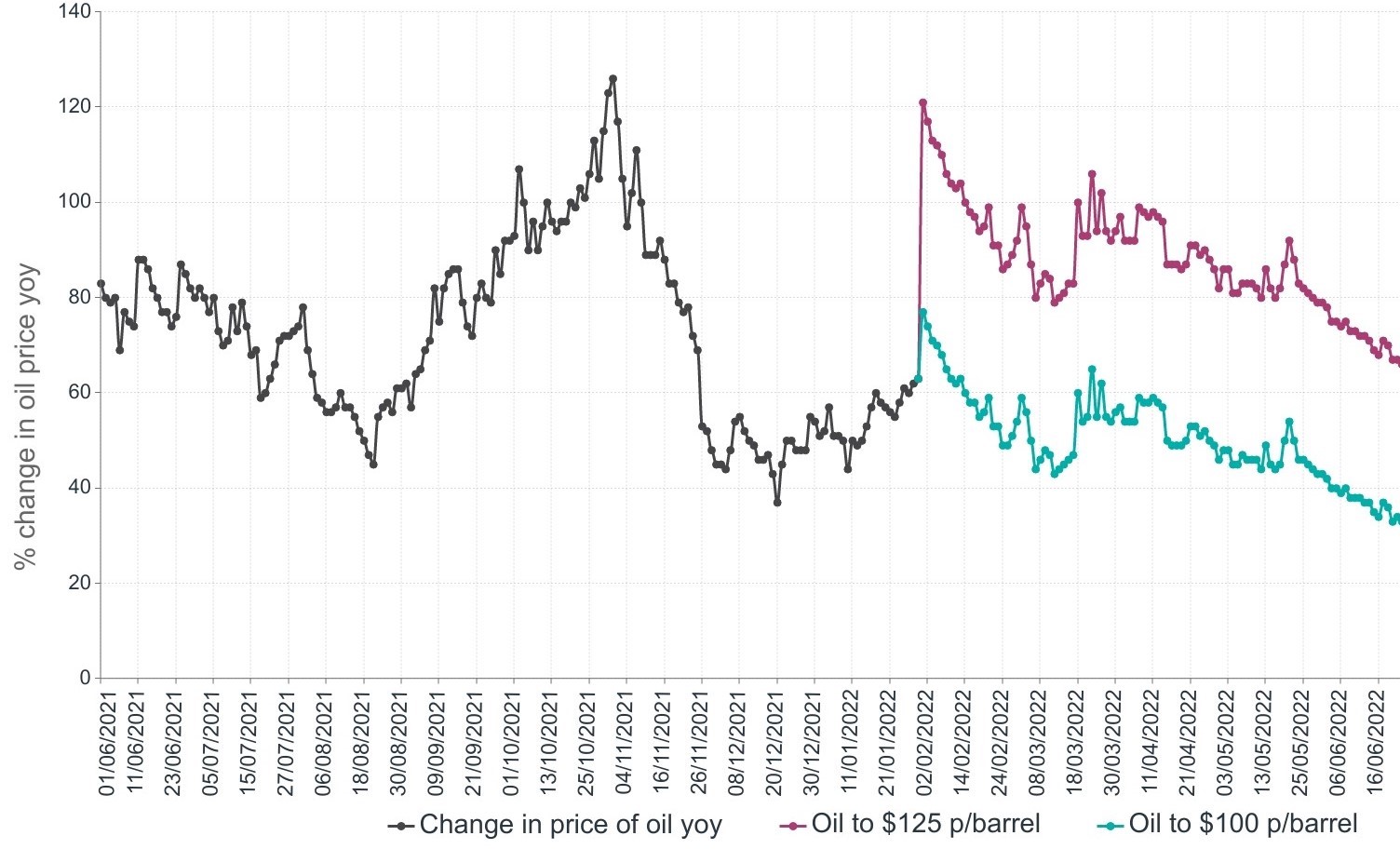

To consider the potential impact of higher oil prices on the global economy, we model two supply shocks where the price of oil increases to a sustained level of $100 and $130 per barrel. Modelling the price of oil is notoriously difficult given the range of factors that can influence the price level, and these figures should therefore be taken as indicative rather than precise estimates. This analysis finds that any economic fallout from the Russia-Ukraine tensions should be less severe than previous shocks. With Eurozone GDP forecast to expand by 3.9% in 20225, these shocks could cut growth to between 2.8% and 3.5%[ii].

A sharp increase in the price of oil under a severe supply shock would be inflationary, but a smaller move upwards from the January average (~$85 per barrel) to a sustained price level of $100 would actually be disinflationary over the next couple of quarters. The stylised analysis below shows the impact of these price levels in terms of oil’s contribution to inflation relative to its contribution in January 2022:

- The price of oil immediately increases to $100 and remains at that level until the end of Q3 2022; and

- The price of oil immediately increases to $130 and remains at that level until the end of Q3 2022.

The figure below shows that the contribution of crude oil to inflation will be higher over the next two quarters if the price of oil jumps to $130 (the grey line in the figure below shows the year-on-year oil price change in January 2022. Hence, any datapoint below this line is disinflationary relative to January). This is because the price of oil increased sharply in 2021, which means that for oil to increase inflation further, the price rise would have to be even stronger this year.

However, if the price of oil stays close to $100 then its direct contribution to inflation will be disinflationary over Q1-Q3 2022[iii].

[ii] This analysis does not account for the potential return of Iran to global oil markets.

[iii] This analysis considers the direct impact it does not consider the second-order effects e.g. the relative price increases in other sectors due the oil price change.

Figure 4: A higher price of oil is not necessarily inflationary for the global economy

Source: Andreas Steno, Refinitiv, Tilney Investment Management Services Limited data as at 23 February 2022

Two factors should moderate the damage to the global economy compared to previous oil crises. First, the global economy is far less dependent on oil. Oil intensity, which measures the volume of oil consumed per unit of GDP, tells us about the importance of oil in a society. Since 1970, oil intensity has fallen by 50%, highlight the dwindling importance of oil to the world economy6.

Second, any resulting price spike should be less severe as supply can be brought online at relatively short notice. Higher prices would likely encourage OPEC to raise output. The cartel has around 3.2 mmd/d in spare capacity (around 3% of world output) that can be brought online within a month, which could soften the impact of any price shock7.

A gas supply shock would hurt Europe

Russia supplies around 40% of the EU’s natural gas, which is used to heat homes, generate electricity and power factories8. This leaves the sector exposed to Russian retaliation, although this is likely to be a last resort for Putin given that exports are a crucial source of income for the Russian economy.

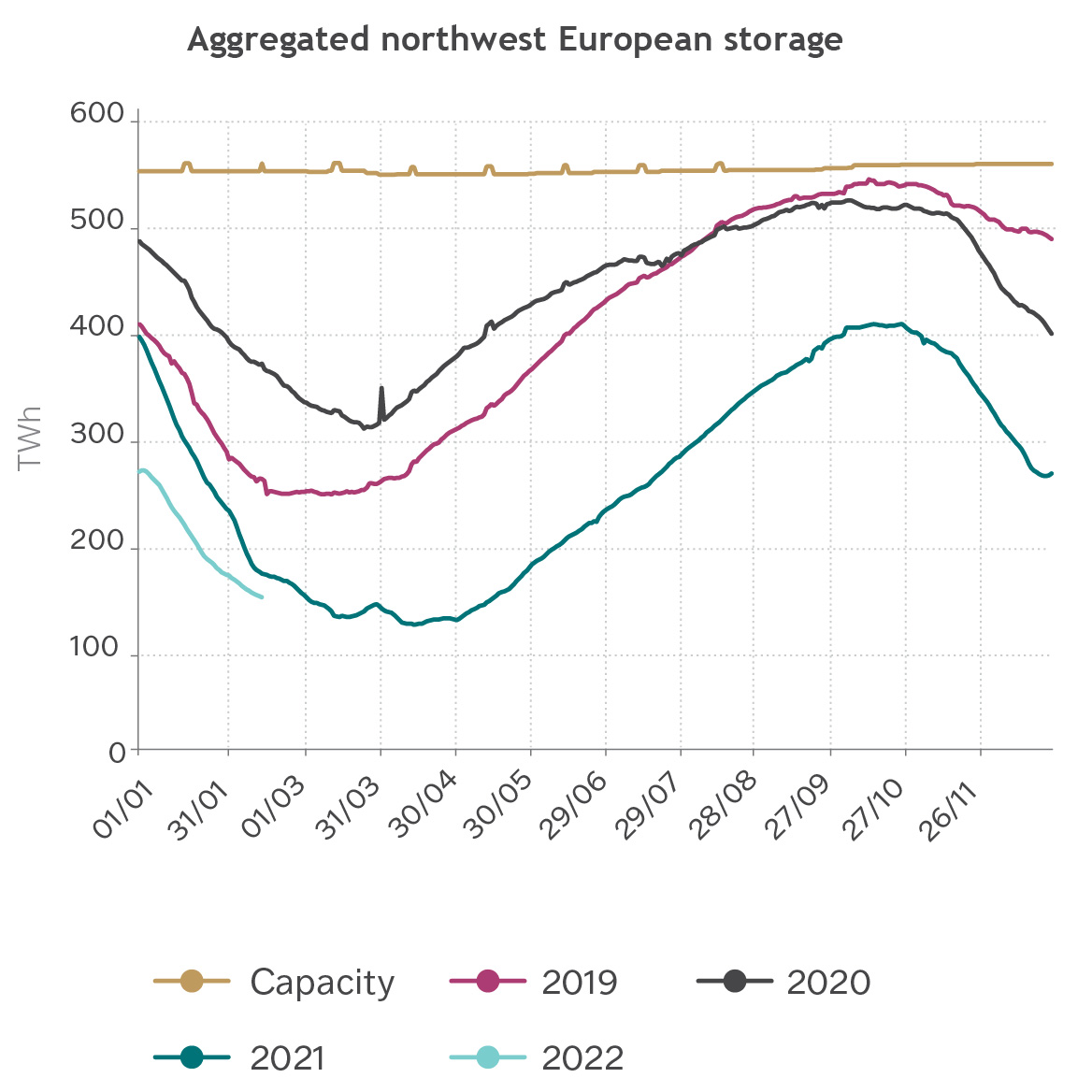

Nonetheless, there is precedent for cutting supplies as a negotiating tactic. In 2005-06, Gazprom, the Russian energy major, constrained supplies in a dispute with Naftogaz, the Ukrainian state-controlled oil and gas company. This led to the price doubling between May and September. There was a similar spike in 2009, when the two companies fell out over a supply contract. Moreover, there is recent evidence that Russia is using gas as a political card once again. The International Energy Agency estimates that Russia cut its gas exports to Europe via pipeline by one-quarter in Q4 2021 compared to the same period in 2020.

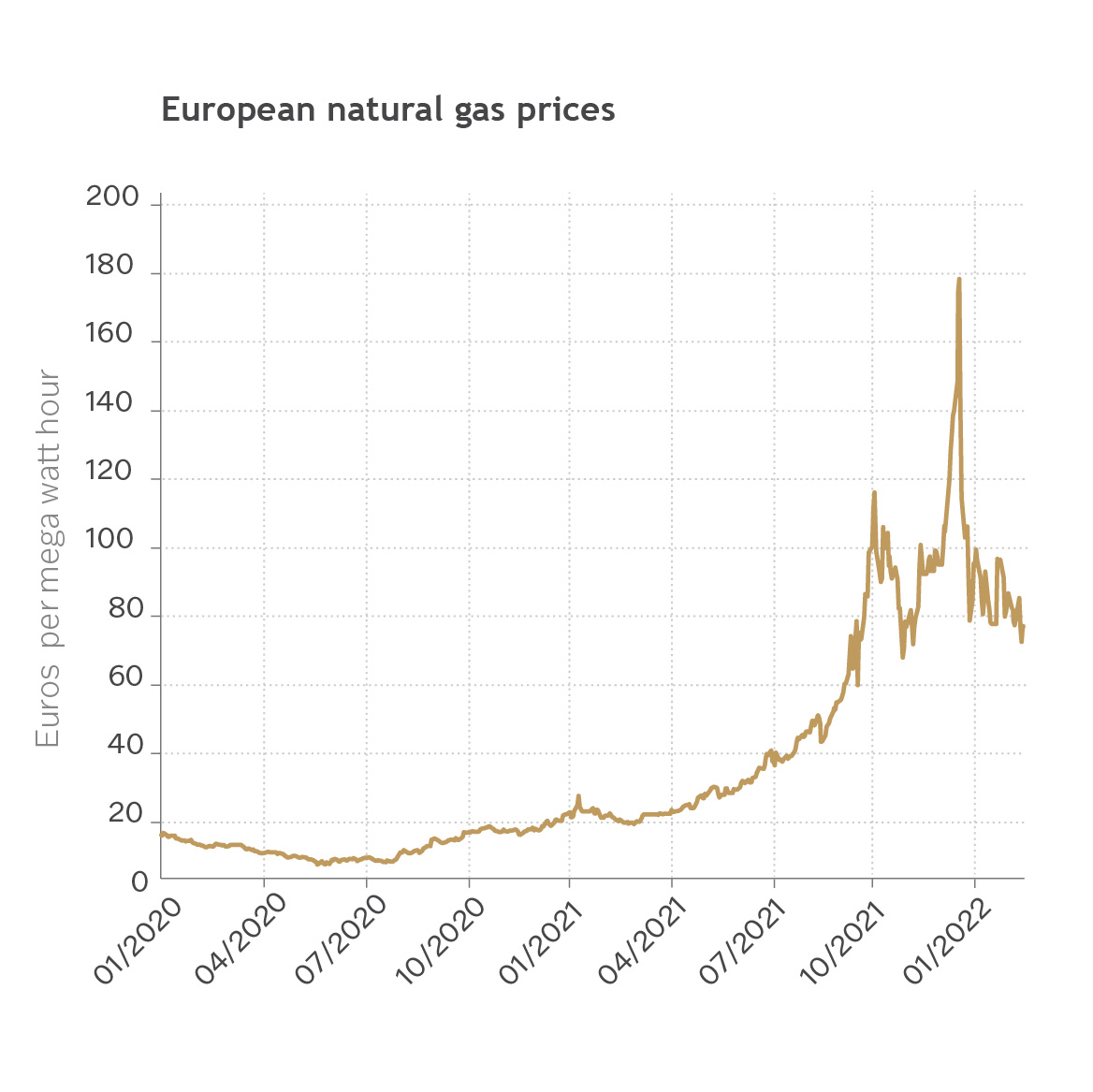

Some of the responsibility for this risk lies with European energy regulators. Over the last decade they have sought to move the European gas market away from fixed long-term contracts with Russia to one led by supply and demand. While this has worked in the favour of consumers over this time as market prices have been consistently lower, this has come unstuck over the last year with prices skyrocketing in the face of lower supply on the continent (Figure 5 below).

Figure 5-6: Natural gas prices are already high in Europe (Fig 5) driven by low supply (Fig 6)

Source: Refintiv Datastream/ Tilney Investment Management Services Limited, data as at 23 February 2022

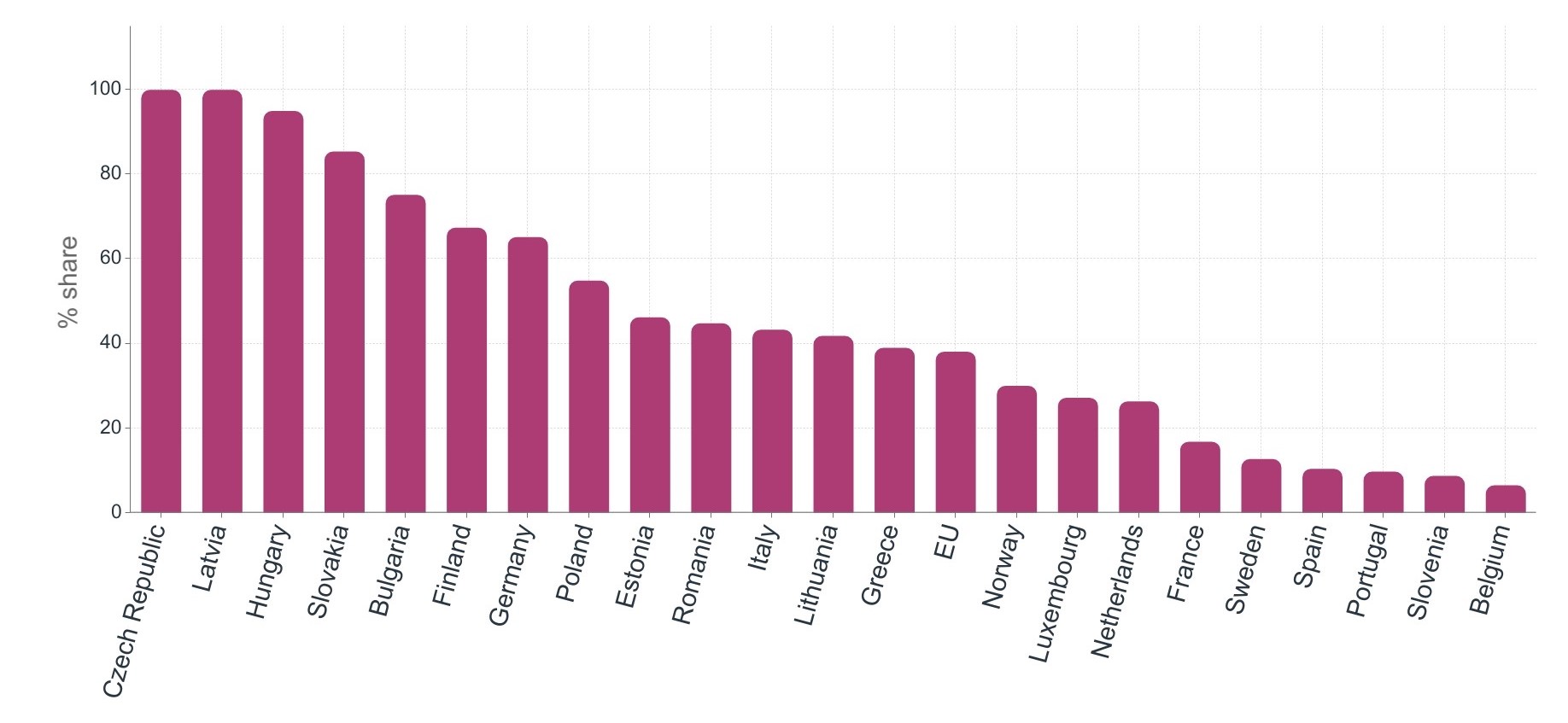

Figure 7 shows that Czech Republic, Latvia, and Hungary are most at risk from a supply shock — close to 100% of their natural gas is from Russia via Ukraine. The West is trying to mitigate this risk by securing Liquefied Natural Gas (LNG) supplies from Asia. The overall impact on Europe will clearly depend on the level of supply disruption. Brugel, an economics think tank, considers two downside scenarios for the Europe gas market9. It finds that a smaller disruption to Russian gas imports would push up prices, but Europe should be able to make it through this winter. In contrast, a worst-case scenario — involving extremely cold weather and major cuts to Russian supply — would see EU-wide storage empty by the end of March 2022. This would present a major challenge for the European economy and gas demand would need to be significantly curbed.

Figure 7: European dependence on Russian gas varies across countries, 2020 % gas imports from Russia

Source: Eurostat/ Tilney Investment Management Services Limited, data as at 23 February 2022

Investors should be prepared for volatility driven by geopolitical poker, but it’s rarely a good idea to drastically change investment strategy

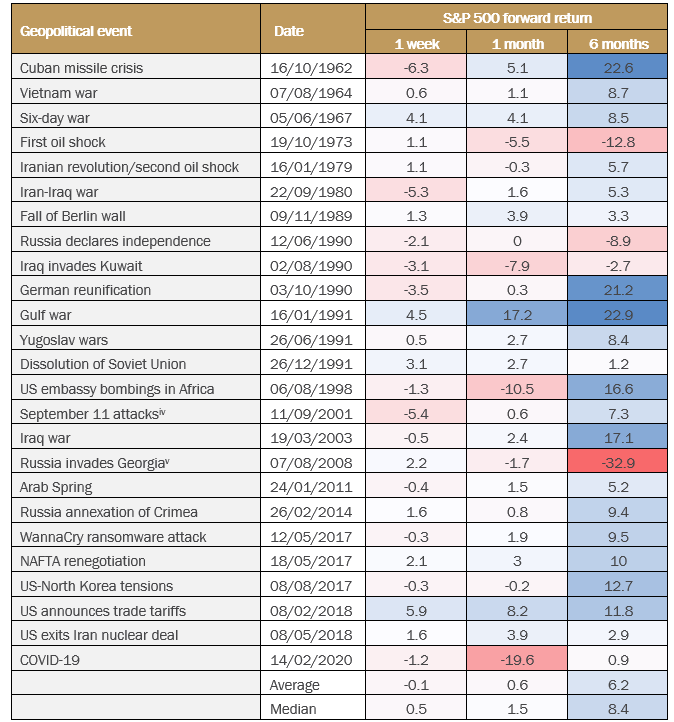

Historically, the market’s response to geopolitical events tends to be short-lived. Only the 1970s oil shocks have had a significant long-term effect on US markets, while the impacts of major events such as the wars in Iraq, the 9/11 bombings and the Arab Spring uprising have only been felt temporarily. Geopolitical risk has already eased during the pandemic.

Table 3: On average, losses resulting from geopolitical events are erased within one month

Source: Refinitiv Datastream, Bloomberg, Blackrock, Tilney Investment Management Services Limited, data as at 23 February 2022

Nevertheless, higher oil prices without higher economic growth can increase input costs for companies and squeeze margins. They can also dampen consumer demand with people spending more on energy bills and petrol, leaving them less to spend elsewhere.

Our analysis shows that, as one would expect, the global energy sector has the highest correlation with oil price changes — that is, energy stocks move in tandem with oil prices. In contrast, the utilities sector has a low correlation, which suggests the sector is relatively insensitive to changes in the price of oil, highlighting its defensive nature. The table also shows that from a regional perspective, Japanese equity markets have the lowest correlation to oil, thereby providing an opportunity to diversify portfolios in the event of disruption.

[iv] After 9/11 stock trading was suspended. When trading resumed on the 17 Sept, the S&P 500 eventually fell 12% from the 9 September before bottoming out on the 21 September.

[v] The Russian invasion took place during the 2008 financial crisis, which explains the sharp contraction seen over the next 6 months.

Table 4: The global energy and materials sectors have the highest correlation oil price changes

Source: Refinitiv Datastream, Tilney Investment Management Services Limited, data as at 23 February 2022

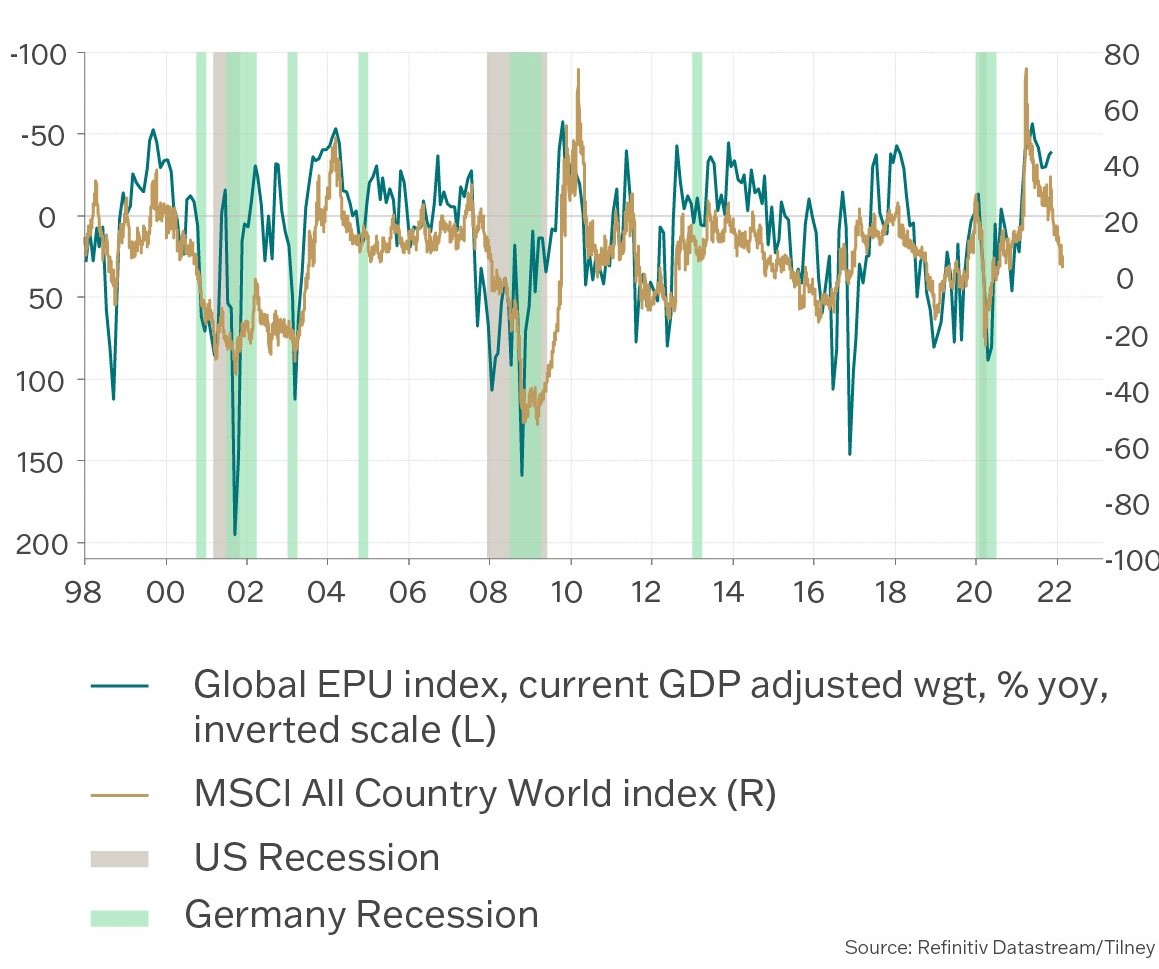

Equities are also at risk from changes in economic policy uncertainty (EPU) levels that result from tensions between Russia and Ukraine. Higher uncertainty can force businesses to hold back on capital spending, which puts the brakes on economic growth. The figure below shows that highly uncertain periods are associated with recessions in the US and Europe’s largest economy, Germany. While EPU has not yet picked up, the invasion should cause a spike in uncertainty, which is likely to destabilise global equities.

Figure 8: Global equities tend to move in line with economic policy uncertainty, Global Economic Policy Uncertainty[vi] (scale inverted) vs World equities

Source: Refinitiv Datastream, Tilney Investment Management Services Limited, data as at 23 February 2022

Ultimately, the Russia-Ukraine situation is another problem for stock markets to digest at a time when they were already starting to look vulnerable from higher inflation and interest rate uncertainty. But we will continue to monitor the situation carefully and will adjust our positioning accordingly should we see a shift in the fundamental outlook. For now, considering the balance of probabilities as long-term investors, we favour maintaining current equity exposure.

[vi] The Economic Policy Uncertainty index quantifies newspaper coverage of policy-related economic uncertainty.

Sources:

1 Refinitiv Datastream/Tilney Investment Management Services Limited, data as at 24 February 2022

2 Financial Times, “Huawei revenues fall 30% in 2021 but company is cautiously optimistic, data as at 31 December 2021

3 Bloomberg/Tilney Investment Management Services Limited, data as at 24 February 2022

4 BP (2021), Statistical Review of World Energy 2021, 1 July 2021

5 IMF 2022 Eurozone GDP forecast is 3.9%, data as 1 January 2022

6 Crystol energy 2021, data as at 21 May 2022

7 Deutsche Bank “Russia/Ukraine: Assessing the risks to the European economy, data as at 15 February 2022

8 Eurostat, data as at February 2022

9 McWilliams, B., Sgaravatti, G., Tagliapietra, S. and G. Zachmann (2022) ‘Can Europe survive painlessly without Russian gas?’, Bruegel Blog, 27 January 2022

Important information

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication.

The value of investments and the income from them can go down as well as up. The investor may not receive back, in total, the original amount invested. This article is based on our opinions which may change.

Tilney Investment Management Services Limited is part of the Tilney Smith & Williamson group.

Tilney Investment Management Services Limited is authorised and regulated by the Financial Conduct Authority

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Market news

2024 Autumn Budget Overview: The key announcements from Chancellor Rachel Reeves