Investing in renewable energy

Understand more about the UK’s energy transition with insights from our investment research expert Tom White, including clarity to help investors identify authentic renewable investments.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Tom White

Published on 30 May 20247 minute read

Recent eyewatering energy bills landing on our doormats have placed a renewed focus on the need to move the UK’s power supplies away from fossil fuel sources, reducing our vulnerability to the volatile global oil and gas markets. Over the past few years, the UK government committed to producing 95% of its electricity from low-carbon sources by 2030 and to fully decarbonise our electricity system by 2035. A key part of this low-carbon change is the transition to renewable energy. This term refers to wind, solar, hydro and bioenergy.

This article outlines the UK’s energy transition, explains the pros and cons of renewable investments including investing in wind farms and solar parks and clarifies how investors can identify authentic renewable investments.

UK’s transition to wind, solar, hydro and bioenergy

The shift to renewable energy has been quietly underway for some time. Take a walk in the British countryside or along our coast and you’re likely to have spotted some of the many wind turbines across our landscape and seas. Solar parks are less common, but even city-dwellers can spot solar panels on the rooftops of houses and increasingly of businesses – Tesco already has solar panels on 40 of its stores and recently announced plans to install them on another 100.1

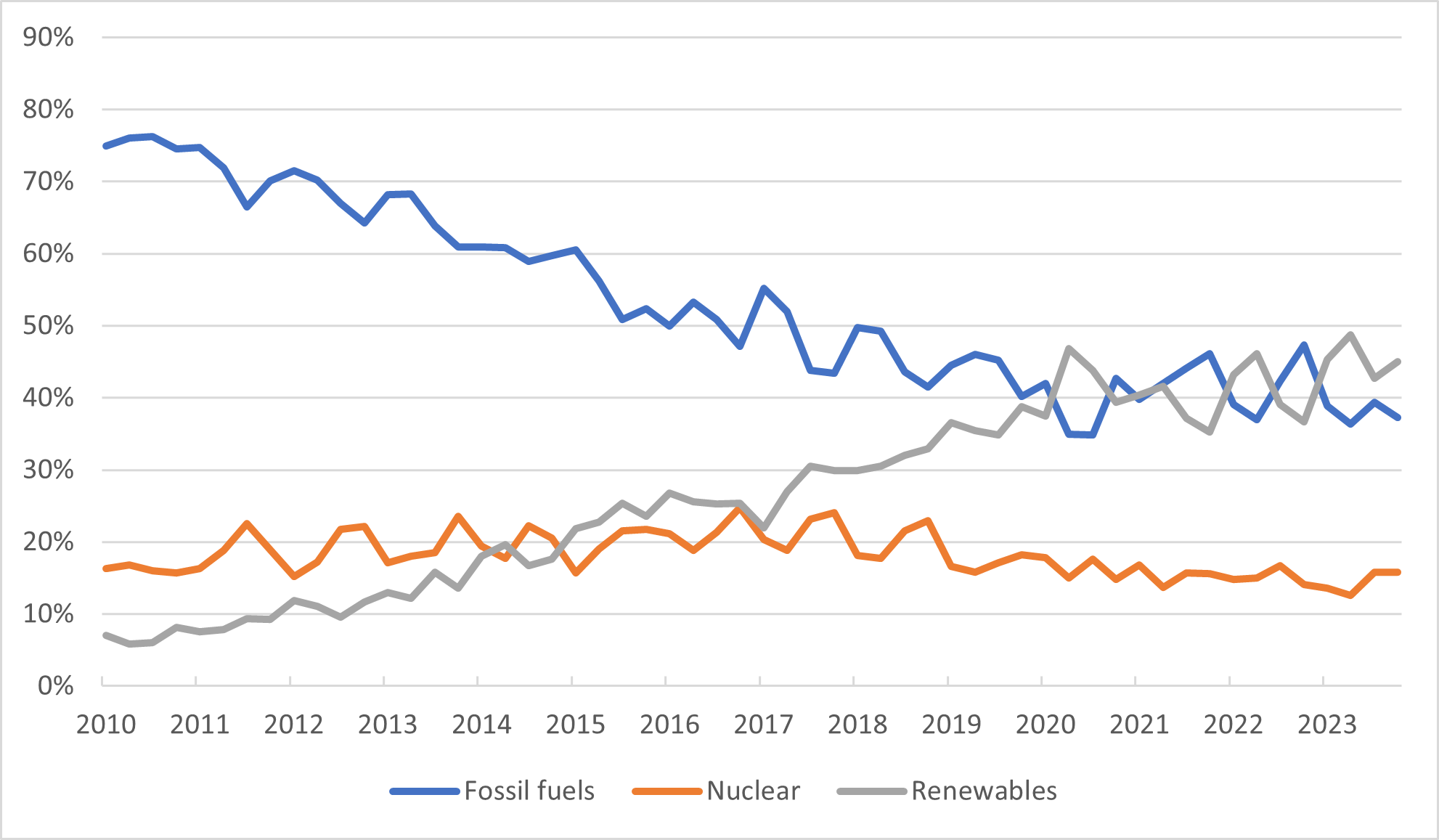

This proliferation is reflected in the sector’s contribution to the UK’s electricity generation, which is growing relentlessly. Looking at the graph below, as recently as 2023, less than 10% of our electricity came from renewables. Today, depending on how windy or sunny it is, it's around 40%. In 2020 power generated by renewable energy exceeded that produced from fossil fuels (gas, oil and coal) for the first time.

UK electricity generation by source

Source: Department for Energy Security and Net Zero, as of 28 March 2024

This growth is set to continue. In 2019 the UK became the first major economy to commit to net zero emissions, and cleaner electricity is a key part of that. Wider awareness of environmental issues means that consumers and businesses are also increasingly uncomfortable with receiving their power from ‘dirty’ sources.

Investors need to carefully research environmentally friendly investment claims. It’s a good idea to request confirmation and verification that investments claiming to be renewables can be evidenced for the lifecycle of the asset.

How investors can recognise renewable investments

Renewable energy is an attractive investment option to many investors, but it can be tricky to identify authentic renewable investments due to many overstating sustainability credentials. Thankfully the Financial Conduct Authority (FCA) has implemented straightforward markers to help investors identify a renewable investment, including:

- Are all claims correct and substantiated? FCA regulations require companies to substantiate all sustainability related claims for the entire life cycle of the investment, to improve transparency and minimise greenwashing

- Is all information clear and accurate? All communicate and information must be fair, clear and not misleading. This includes the companies selling investments to providers like Bestinvest

Our favoured renewable investments

Though investors can access renewables via shares in companies such as turbine manufacturers, these are highly correlated to equity markets generally and come with similar volatility. This means prices going up and down, often rapidly, and the risk that investors may not get back what they put in.

That's why we favour investing in wind farms and solar parks themselves, using investment companies listed on the London Stock Exchange. There are a number available which we believe to be high quality and have outlined below. Remember, this is not advice to invest in these specific stocks and you should carry out your own research.

The Renewables Infrastructure Group – In what is a fairly new sector this is one of the rare trusts with a proven pedigree, having launched in 2013 and being managed by two leaders in the field, InfraRed Capital Partners and Renewable Energy Systems. Operating in the UK, Ireland and continental Europe, it invests primarily in wind farms but also has some exposure to solar (around 11%). In 2023 its portfolio generated 5,986 GWh of electricity, enough to power 1.8 million homes.

Octopus Renewables Infrastructure Trust – This is a newer vehicle having launched in 2019, but still has an experienced manager in the Octopus Renewables team which was formed in 2010. It takes a more diverse approach, with the portfolio split almost equally between wind and solar assets and spread across the UK and continental Europe. Another differentiator is that as well as operational assets, it also invests in assets in their construction phase. Though these are riskier than operational assets, they have the potential to generate higher returns.

The attractions of renewables

Their low carbon credentials make renewable energy trusts highly attractive from an environmental point of view, but we believe they also have several strong attributes as investments:

Income

Our favourite renewables products are designed to pay out high levels of income, typically around 5-6%. This appears attractive even compared to the high-yielding UK equity market and substantially higher than that available from global equities or bonds. Note that this level of income is not guaranteed, and the amount paid out could be less than this. (Source: Morningstar 13 May 2024)

Total returns

Renewable investments have also delivered attractive returns on a total return (capital growth plus income) basis, though investors should be aware that it’s those high yields that have delivered most of these gains – capital growth has been more moderate. Although past performance isn't a guide to the future. (Source: Morningstar)

The renewable investment companies invest in physical assets with robust underlying revenues. These revenues are often backed by governments or by contracts with utility companies, and often linked to inflation.

As a result, they tend to be less volatile than funds investing in equities, and even those investing in renewable energy equities. However, these are listed vehicles and investors should be aware they can still experience periods of share price volatility.

Diversification

Diversification – combining assets with different characteristics to improve the balance of a portfolio – is highly prized in the investment world. However, it has also become increasingly hard to come by.

With individual stock markets dominated by giant global companies their fortunes have become increasingly intertwined, so spreading your investments around the world doesn’t carry the same benefits it used to.

Diversification is an increasingly rare commodity, but renewable energy investments provide it.

They offer lower correlations to mainstream assets such as equities or bonds – in layman's terms, they march to a different beat. As with all investments, investors should remember that investments go down as well as up and they may not get back the amount originally invested. Some ethical funds may, by definition, have a limited investment universe and this may affect performance.

The negatives associated with renewable investments

Of course, no asset class is without downsides. Perhaps surprisingly, some key ones for renewables are environmental

- Recycling – the blades of wind turbines are hard to recycle and can be reused by other industries or buried when they reach the end of their lifespan. However, the rest of the turbines are heavily recyclable

- Intermittency of supply – whilst gas can be stored and then used to generate electricity as required, wind and solar output varies depending on the weather; a lack of sunshine and wind meant renewable energy supply was lower in 2021 than in 2020. However when it is sunny or windy the electricity generated can exceed demand. Whilst the excess power can often be exported to Europe, battery technology to store it for future use remains in its infancy

- Share price discounts – though the trusts’ underlying asset values are typically fairly stable, their share prices are often not. Historically they often traded as premiums, i.e. their share prices exceed the book value of their assets. However, since 2022 share prices have fallen and are now some way off their peaks, though this does mean they sit below the book value of their assets, potentially offering an attractive entry point

Support for investors interested in renewables

Today’s investors are supported by stricter regulations that compel companies to clarify the exact nature of their renewable and environmentally friendly claims that must be evidenced for the lifetime of the investment.

The future of renewables

We believe renewable energy trusts have become attractive investments. Many provide a good income, solid total returns including some protection from inflation, as well as diversification from traditional asset classes.

With the demand from consumers and businesses and the commitments from governments in the UK and elsewhere, there are reasons to suggest they should continue do so.

It’s good to note nothing in this article is intended to constitute advice or a recommendation, and investors should conduct their own research. If you are in doubt as to what action you ought to take, you should seek professional advice.

How can Bestinvest help you?

- You can buy renewable energy investments and many more via our investment search tool

- These can be added to an ISA, Junior ISA, SIPP or Investment Account

- We also offer free coaching with qualified experts to help you get the best from your investing or if you need more, we offer a one-off affordable investment advice service

Source