Coping with rising US interest rate headwinds

On 16 March the Federal Reserve Open Market Committee (FOMC) raised interest rates for the first time since 2018. We consider that rising interest rates will have significant implications for equity markets. Some sectors and geographies are likely to do well, whereas others could be at risk.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Daniel Casali, Chief Investment Strategist

Published on 24 Mar 20226 minute read

Inflation has become a significant pressure since markets started to reopen in the wake of the pandemic. In the US, February headline CPI inflation rose 7.9% from a year ago, its highest rate since 19821. Central bankers and money markets are now moving to mitigate inflation risk in the global economy. The Bank of England raised interest rate by 0.25% to 0.75% in March, the first time it has hiked rates for three consecutive meeting since 1997. The ECB is also sounding concerned about rising inflation and has warned of monetary tightening ahead. Indeed, the swap markets are now anticipating European rates to rise several times by the end of 2022, even in the face of supply chain disruption caused by the Ukraine conflict.

Importantly, the US government bond market is now discounting higher Treasury yields in nominal and real terms. After reaching a record low of just 0.5% in March 2020 at the height of the Covid-19 virus nadir, the 10-year Treasury yield benchmark has now broken well through the 2% level1. The real yield (from the Treasury Inflation Protected Securities market) also appears to have troughed, which suggests that the US economic recovery is now on a firmer footing since the virus outbreak.

US nominal 10-year Treasury yield and real yield, %

Source: Refinitiv Datastream,Tilney Investment Management Services Limited, Data as at 23/03/2022

*Nominal less implied breakeven rate of Inflation-Protected Security (TIPS)

Looking forward, we expect upward pressure on yields to persist: bond yields typically rise throughout policy tightening cycles until markets sniff an imminent recession or a central bank pivot. We are some distance from that point. In our view, this is not likely to be an issue until 2023 or 2024. In the meantime, the new environment has implications for the stock market and the type of companies that can thrive.

The impact for equity markets

As real yields move higher, low yield and no yield assets are starting to struggle. This group of assets runs the risk gamut from speculative cryptocurrencies to safe sovereigns. It will also exert a headwind on those companies whose valuations are based on assumptions about high future cash flows. This is because higher yields increase the cost of capital used to value these companies, which, all things equal, results in a lower valuation. It is these areas that investors need to side-step in the near-term, as they may struggle to outperform in relative terms.

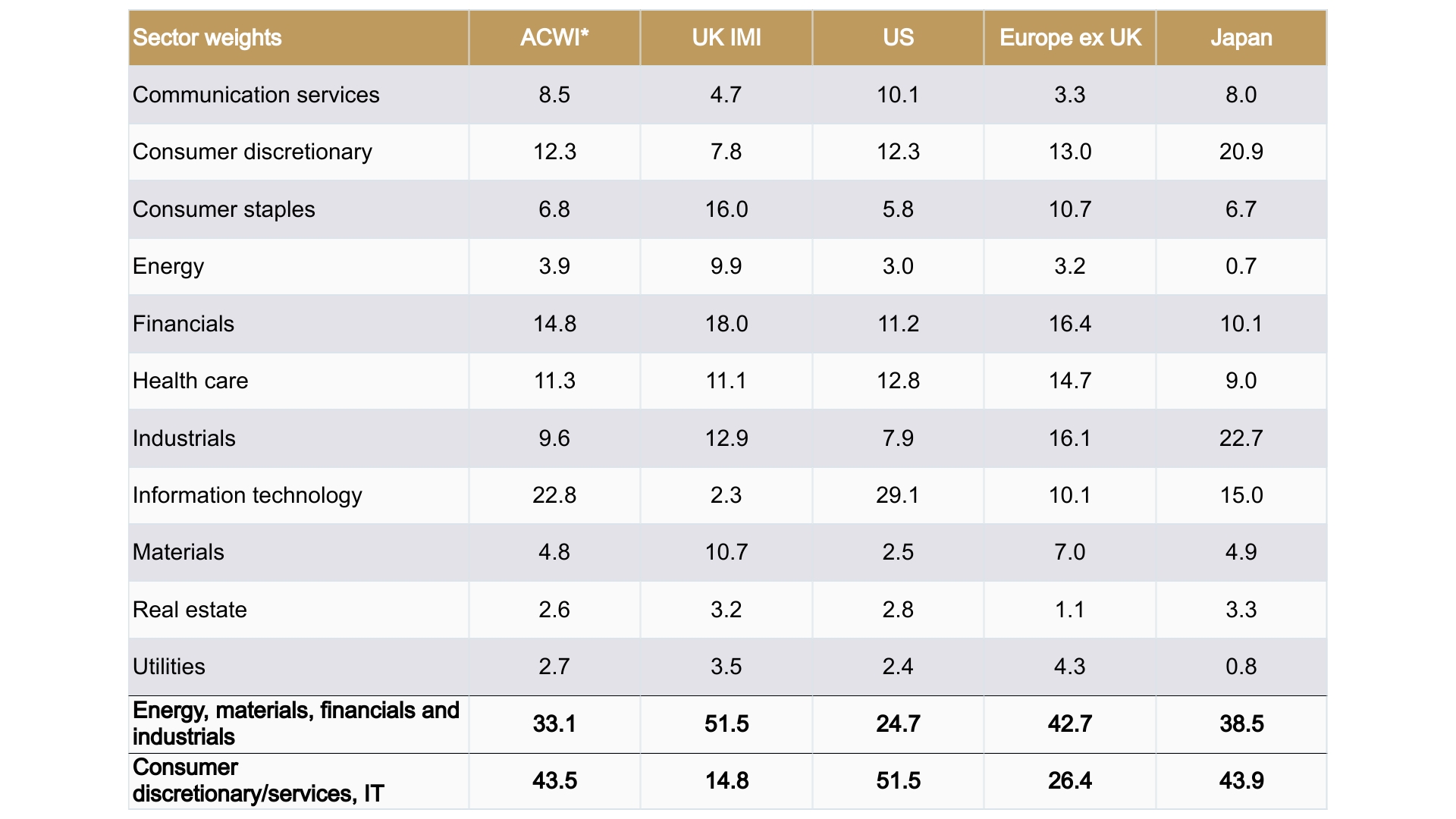

Out of all the major markets, the US equity market is particularly vulnerable to rising real rates due to its high 52% share of sectors that have gained from loose monetary policy (and lockdowns), like communication services, consumer discretionary (think Amazon) and Information Technology1. In contrast, the UK has benefitted from its relatively large 52% share to sectors that are now benefitting from rising raw material prices (energy and materials), higher interest rates (financials) and strengthening manufacturing activity to relieve supply-chain disruption (industrials).

Source: Refinitiv Datastream/Tilney Investment Management Services Limited, data as at 23 March 2022

*All Country World Index

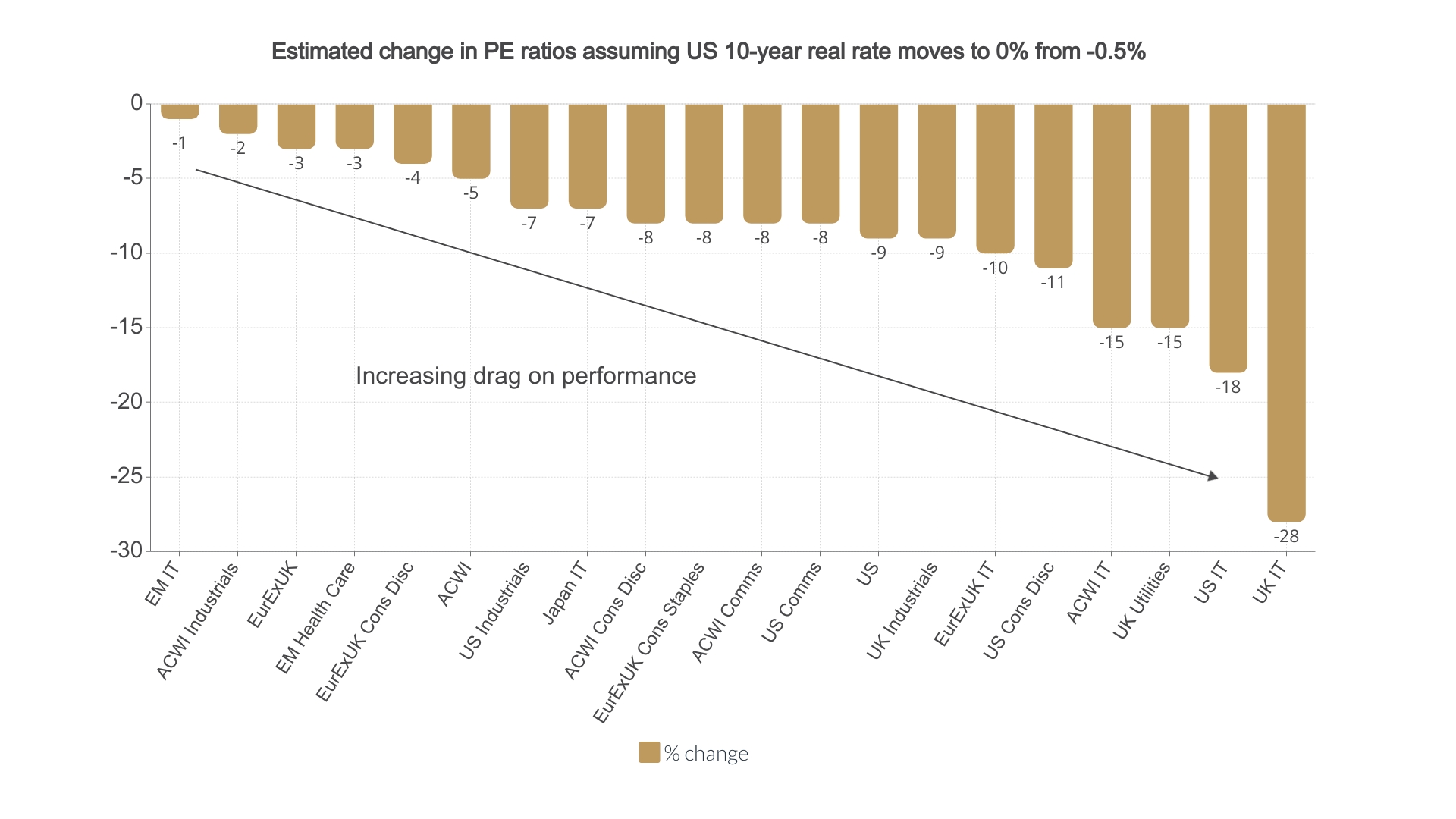

Some market participants assume that this affects the high-growth technology sector and little else. Certainly, technology is sensitive, but our analysis shows there are other sectors caught in the same headwinds. To quantify the drag on equity performance from rising US real rates, we use a two step-process. First, we segregated those sensitive equity markets and equity country sectors where valuations were statistically driven by US real rates over the past 4 years. Second, for those selected sectors we assumed a scenario where US 10-year real Treasury yields move from their current rate of around -0.50% to zero and determined how much it would reduce their forward price-to-earning (PE) ratios1. Our assumption is that the drag on PE ratios from rising real yields should identify relative underperformers.

The results show that US sectors (not surprisingly) are most sensitive to higher US real rates given its equity structure and the proximity to its domestic bond market. Other central banks are also in the process of raising rates, like the UK and possibly the ECB by the end of the year. So this analysis also highlights some other non-US sectors that are vulnerable to US rates. These include Europe ex-UK, as well as its consumer staples, consumer discretionary and IT sectors. Within the UK, industrials and utilities are also vulnerable, while it’s IT in emerging markets and Japan. Investors should be wary of their exposure to these areas of global market.

Source: Refinitiv Datastream/Tilney Investment Management Services Limited, data as at 23 March 2022

Macro risks from higher rates

Global equities started the year on a negative footing even before the Russian-Ukraine conflict. Before the invasion on 24 February, the MSCI All Country equity benchmark was down nearly 9% in GBP terms likely due to investor uncertainty about rising US rates1. Provided higher rates do not stall the economic expansion, less rate sensitive value-focussed equities (e.g energy, materials and financials) are well placed to recover from trend GDP growth and pent-up demand from the pandemic fuelling the consumer recovery. Nevertheless, there are two key macro risks for investors to monitor.

1: Debt burden on the economy

Higher interest rates raise the cost of borrowing and therefore leave less money to be spent elsewhere, whether that is by governments, consumers, or businesses. This has the potential to reduce economic growth.

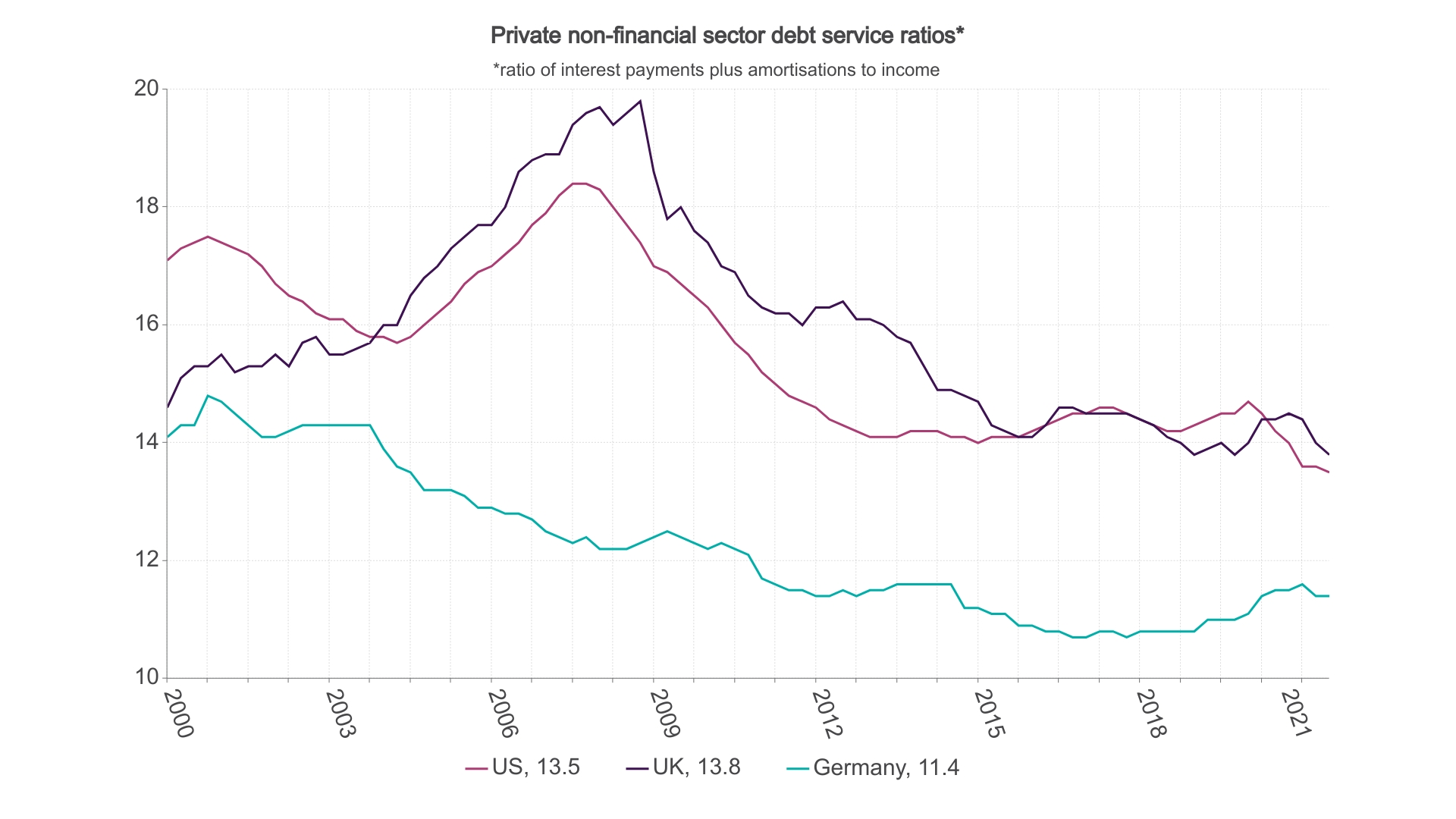

Undoubtedly, aggregate debt burdens are higher, particularly after the pandemic. However, debt build up since the Global Financial Crisis has been focused in the public sector or debt backstopped by the Federal Reserve (such as corporate bonds).

In the private sector, households’ share of the overall debt burden has dropped significantly as a share of GDP, so that debt servicing ratios are at record lows. In the corporate sector, upward pressure on credit spreads should be limited due to elevated profit margins and low unemployment driving growth and profits sufficiently to meet debt payments. In short, higher rates for the private sector (in aggregate) are not really an issue at historically low interest rates.

Source: Refinitiv Datastream/Tilney Investment Management Services Limited, data as at 23 March 2022

2: Pace of Fed rate hikes

For the time being, Federal Reserve rate hikes have been well-signalled in money markets. The risk is that interest rates need to rise faster than expected. However, we believe the Federal Reserve won’t want to dent the nascent economic recovery by becoming too hawkish and particularly given the geopolitical uncertainty from the Russian invasion of Ukraine.

In summary, we expect US rates to continue to rise over the next 12 months at least. Considering that this new monetary policy environment changes the landscape for investors and the balance of risk and opportunities, we would focus on those markets and sectors that have historically been less rate sensitive, which we anticipate being relative outperformers. “Don’t fight the Fed” has been a successful mantra for investors in the past. This is likely to ring true again in the coming months.

Important information

This document is solely for information purposes and is not intended to be, and should not be construed as investment advice. Whilst considerable care has been taken to ensure the information contained within this commentary is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The opinions expressed are made in good faith, but are subject to change without notice.

You should always remember that the value of investments can go down as well as up and you can get back less than you originally invested. Past performance is not an indication of future performance.

Issued by Tilney Investment Management Services Limited, which is authorised and regulated by the Financial Conduct Authority.

Sources:

1 Refinitiv Datastream, data as at 23 March 22

Get insights and events via email

Receive the latest updates straight to your inbox.

You may also like…

Market news

2024 Autumn Budget Overview: The key announcements from Chancellor Rachel Reeves