UK stock market success

The UK stock market was ahead of almost every major market in 2022. Why was this and will it continue?

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Tom White

Published on 11 Jan 20236 minute read

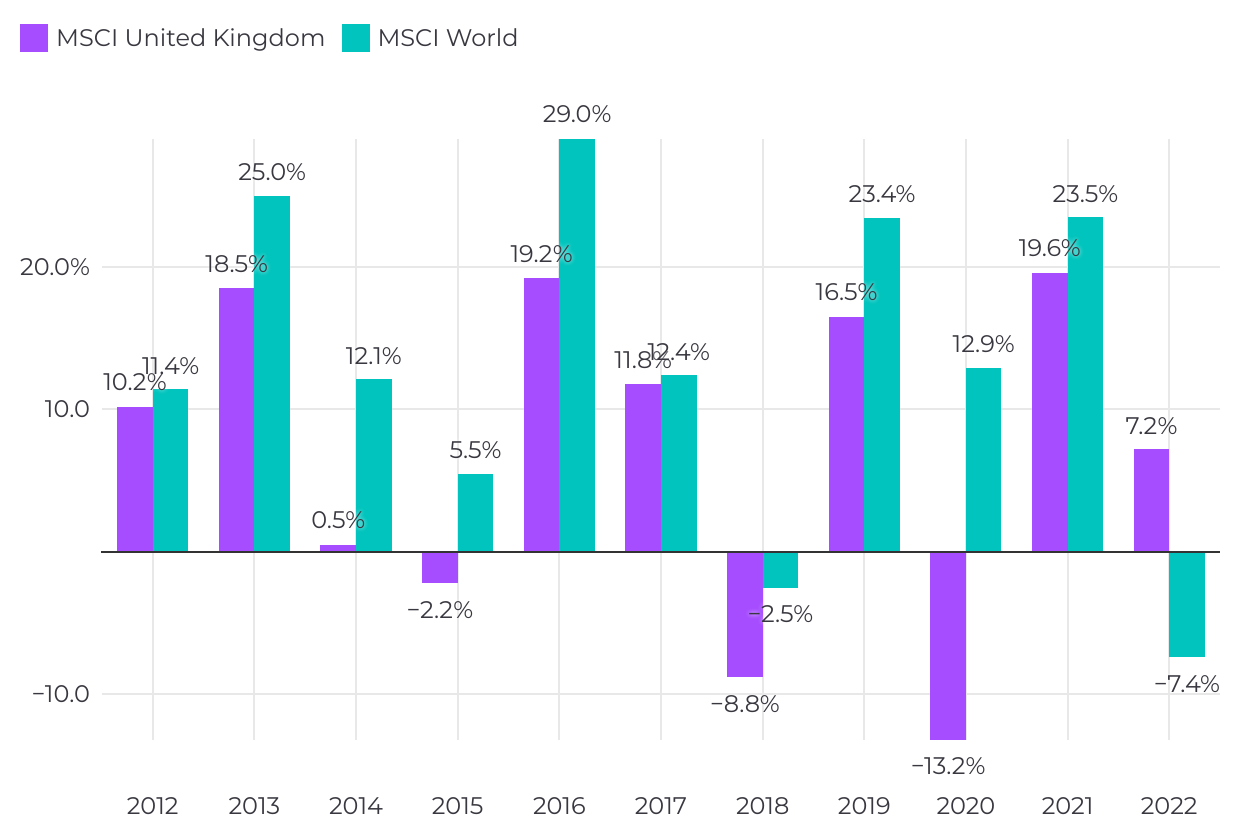

There were few winners in last year’s turbulent markets but - perhaps surprisingly - one of them was UK equities. Investors peering nervously at their portfolios might be surprised to see that, amid all the red ink, the UK market had risen +7.2% by the end of the year (as measured by the MSCI United Kingdom Index). This compares to a -7.4% drop in global equities (MSCI World Index) and left the UK ahead of almost every major market in 2022.

The outperformance is particularly surprising given the UK market’s recent history. Before 2022 it had been on a seriously bad streak, underperforming global equities for 10 calendar years in a row. It has also had to contend with some volatile politics, with three prime ministers and four chancellors of the exchequer in a single year.

So why did the UK’s fortunes reverse last year? And perhaps more importantly, can investors expect it to continue?

UK equities consistently lagged global equities – until 2022

Source: Lipper for Investment Management, as at 31 December 2022

It’s not the economy…

It’s tempting to assume the recent strength of the UK stock market is down to the economy. However, economic growth last year was barely positive and, over time, the UK’s stock-market performance shows little correlation to its economy anyway.

This isn’t surprising. The UK market is dominated by big, global companies such as Shell, AstraZeneca and Unilever, where revenues and profits are generated throughout the world. In total around 75-80%* of the UK stock market’s revenues come from outside the UK, so the UK’s domestic economy has little bearing on its success.

There are some UK companies that are heavily dependent on the UK economy. The 2022 performance of Greggs (-26.6%), JD Wetherspoon (-53.8%) and Hotel Chocolat (-69.2%)* paints a different picture of how the market believes things are going for the UK.

But UK-focused companies like these are typically smaller, and so have a similarly small impact on the market as a whole. This is largely driven by those big global companies, and what’s more important for them is how the major global economies – Asia, Europe and the US – are doing.

*Source: Morningstar

…it’s the industries

Other stock markets are also dominated by big, global companies, so that doesn’t explain the UK’s strong relative performance last year. The real swing factor was the sector make-up of the UK market.

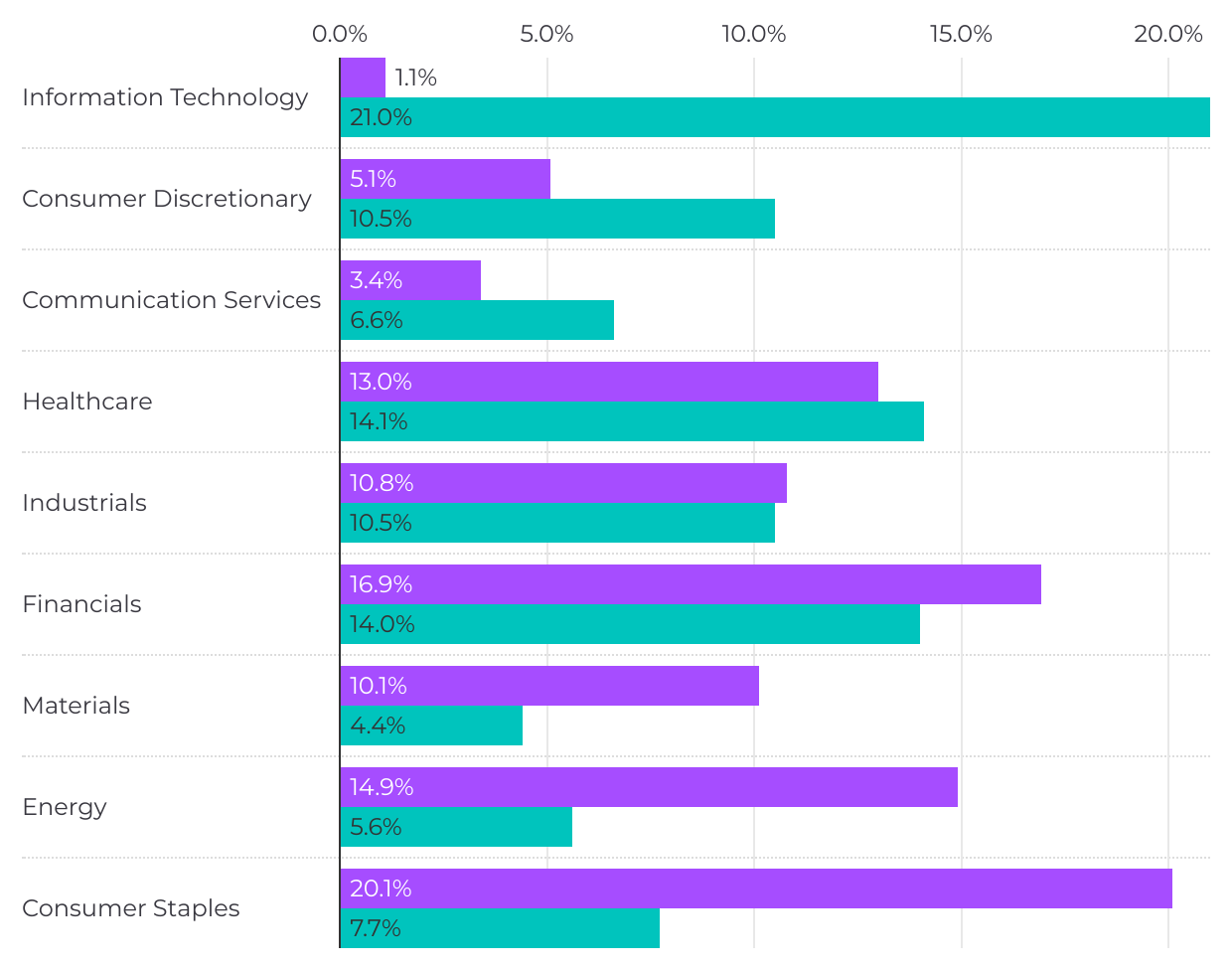

The chart below shows the balance of different industries within the UK market, compared to the global market. Most notably, it has minimal technology exposure - around 1% compared to over 20% globally. These numbers probably understate the UK’s lack of technology companies – our stock market is also underweight in the consumer discretionary sector, home to tech-related companies such as Amazon and Tesla, as well as the communication services sector, which includes Alphabet and Meta.

Instead, thanks to BP and Shell it has a substantial overweight to the energy sector. The consumer staples sector, home of Unilever and British American Tobacco, and the materials sector (mining and chemicals) are also well-represented in the UK market.

Stock market sector weightings – UK versus global

Source: MSCI, as at 30 November 2022

The last 10 years

Different sectors tend to perform differently in different market conditions, or at different times in history – witness the results of banks in the financial crisis, or pharmaceutical companies during the pandemic.

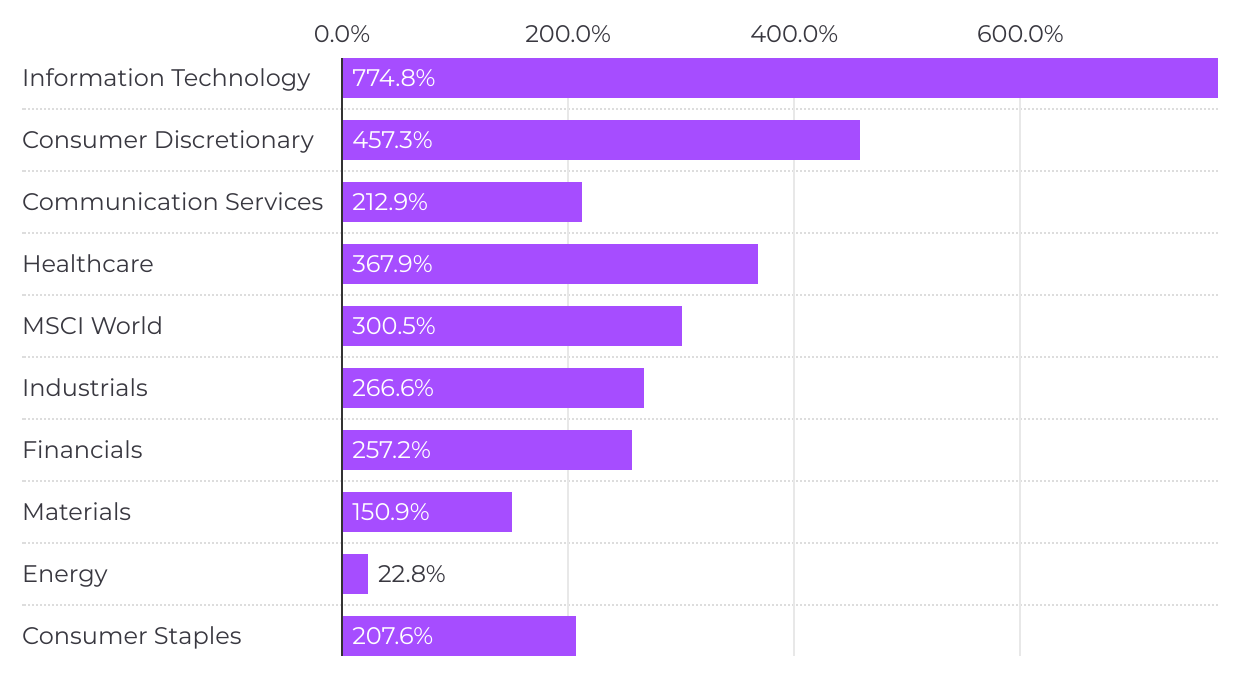

You can see this in the chart below, which shows the performance of the different sectors of the global stock market over the 10 calendar years from 2012-21. Though the market generally boomed over the period, rising +300.5%, that boom wasn’t evenly dispersed.

The technology sector rode the world’s move online to finish 2021 up +774.8%. Meanwhile, hit by slumping oil & gas prices, the energy sector rose just +22.8%. BP and Shell failed to buck the trend, rising +30.8% and +22.0% respectively despite one of the biggest bull markets in history.

Given these performance trends, the UK market’s lack of technology companies and overweight to energy go a large way to explaining its underperformance in recent years. Its heavy weights to consumer staples and materials, and its underweight to the consumer discretionary sector were also major factors.

Global sector performance – 2012-2021

Source: Lipper for Investment Management, as at 31 December 2021

The UK in 2022

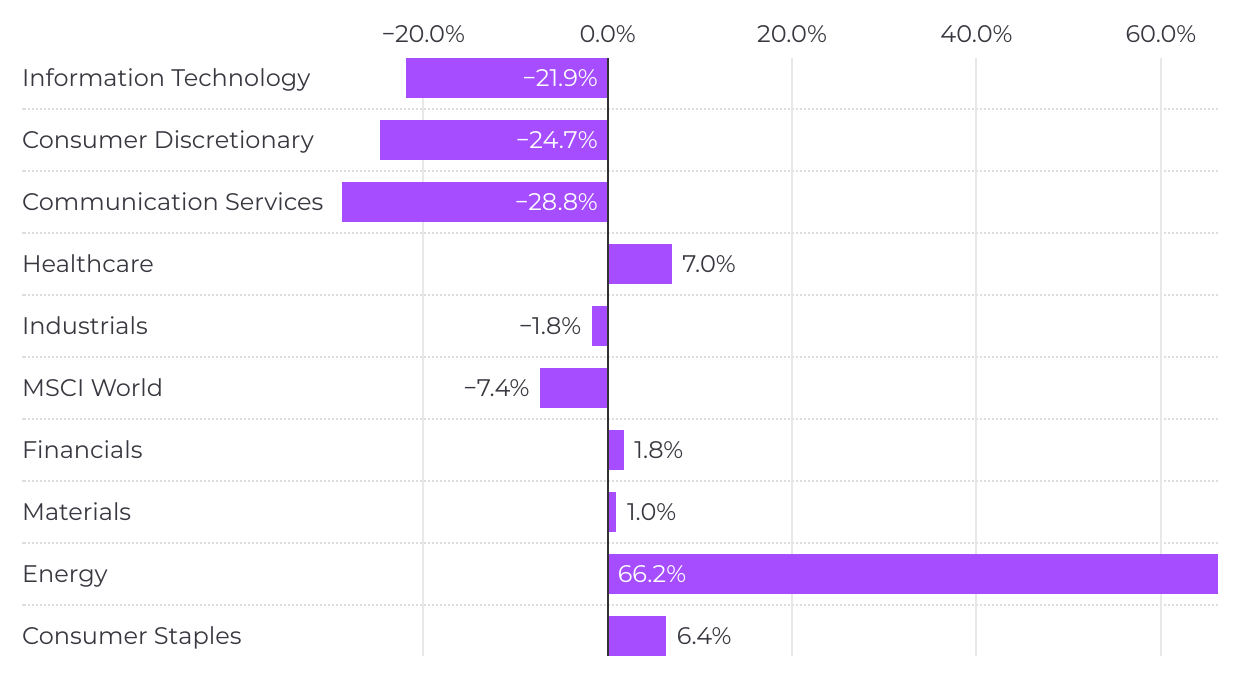

These trends flipped in 2022.

As the global economy wobbled, it became apparent that the tech giants couldn’t grow forever, and certainly not at the rates once predicted. Rising interest rates also put a dent in their valuations, and those of growth stocks generally – higher rates make it more attractive to invest in companies whose profits are in the here and now. The tech sector fell -21.9% over the year.

Meanwhile oil and gas prices, already booming on the back of strong pandemic recovery, gained a further boost from the sanctions imposed against Russia following its invasion of Ukraine. The energy sector rose sharply as a result (+66.2%) and BP and Shell followed suit, even after the imposition of windfall taxes by the UK government.

That broadly explains the UK market’s performance last year. There have been other factors – the consumer staples sector and in particular its tobacco companies have done well, as have certain mining companies. But it’s the strong returns from BP and Shell and the UK’s lack of underperforming tech companies that largely drove its success.

Global sector performance – 2022 calendar year

Source: Lipper for Investment Management, as at 31 December 2022

What does this mean for investors?

The performance of the UK market should not be taken as an endorsement of the UK economy. It might tell you a certain amount about markets globally, how certain sectors are doing and how a handful of companies are doing, but it tells you very little about the strength of domestic economic activity.

The UK stock market has shrunk as a share of the global market in recent decades and we believe portfolios should reflect this – overseas diversification is important. But UK companies arguably represent good value at the moment and can still form a valuable part of a portfolio.

Don’t forget those staycations you took during the pandemic. Balance is important - there’s a big world out there, but don’t forget there are some great opportunities closer to home too.

Investing with Bestinvest

At Bestinvest we have everything you need to choose and manage your own investments:

- Pick from a range of accounts: ISAs, Junior ISAs, SIPPs and Investment Accounts

- Use our investment search tool to find out about, compare and buy funds from across different sectors

- Take inspiration from our investment ideas

- Opt for a Ready-made Portfolio

- Have a free 45-minute session with one of our qualified investment Coaches

Important information

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

The value of an investment may go down as well as up and you may get back less than you originally invested.

Past performance is not a guide to future performance.