Why choose regular saving?

As well as getting you into good habits, regularly investing money can take the emotion out of stockpicking and help you ride out volatility. Take a look to see if it’s right for you.

The value of investments can fall as well as rise and that you may not get back the amount you originally invested.

Nothing in these briefings is intended to constitute advice or a recommendation and you should not take any investment decision based on their content.

Any opinions expressed may change or have already changed.

Written by Cherry Reynard

Published on 20 Jan 20224 minute read

Picking the perfect time to invest in the cut and thrust of markets may have appeal for a handful of investors. But most would rather not have to think too hard about the state of the global economy, inflation or interest rates before risking their capital. Regular saving may be a less exciting approach, but there are sound reasons why it can be an excellent way to invest.

What is regular saving?

Regular saving is how most investors approach the stock market. They invest smaller amounts monthly rather than committing a significant lump sum all in one go. Not only does it impose an important discipline, it can help you remove the emotion from investing. These factors are vitally important for growing wealth over time.

Keeping you disciplined

The easiest way to do anything is to make it a habit. A fixed amount paid at the same time each month means there is no debate on whether it’s a good or bad time to enter the markets, and you can't be tempted to spend it elsewhere. It goes in, little by little, every month, and you don’t have to think too hard.

This is a far easier decision than committing a large lump sum to volatile stock markets all in one go. By committing small sums, you can grow more comfortable with volatility over time.

The key risk for any investor is that they sell out when markets are low and do not give their portfolio a chance to recover. During the early days of the Covid-19 crisis, financial markets snapped back quickly. Regular saving makes investment a habit and helps prevent costly mistakes.

Helping you make mathematically sound decisions

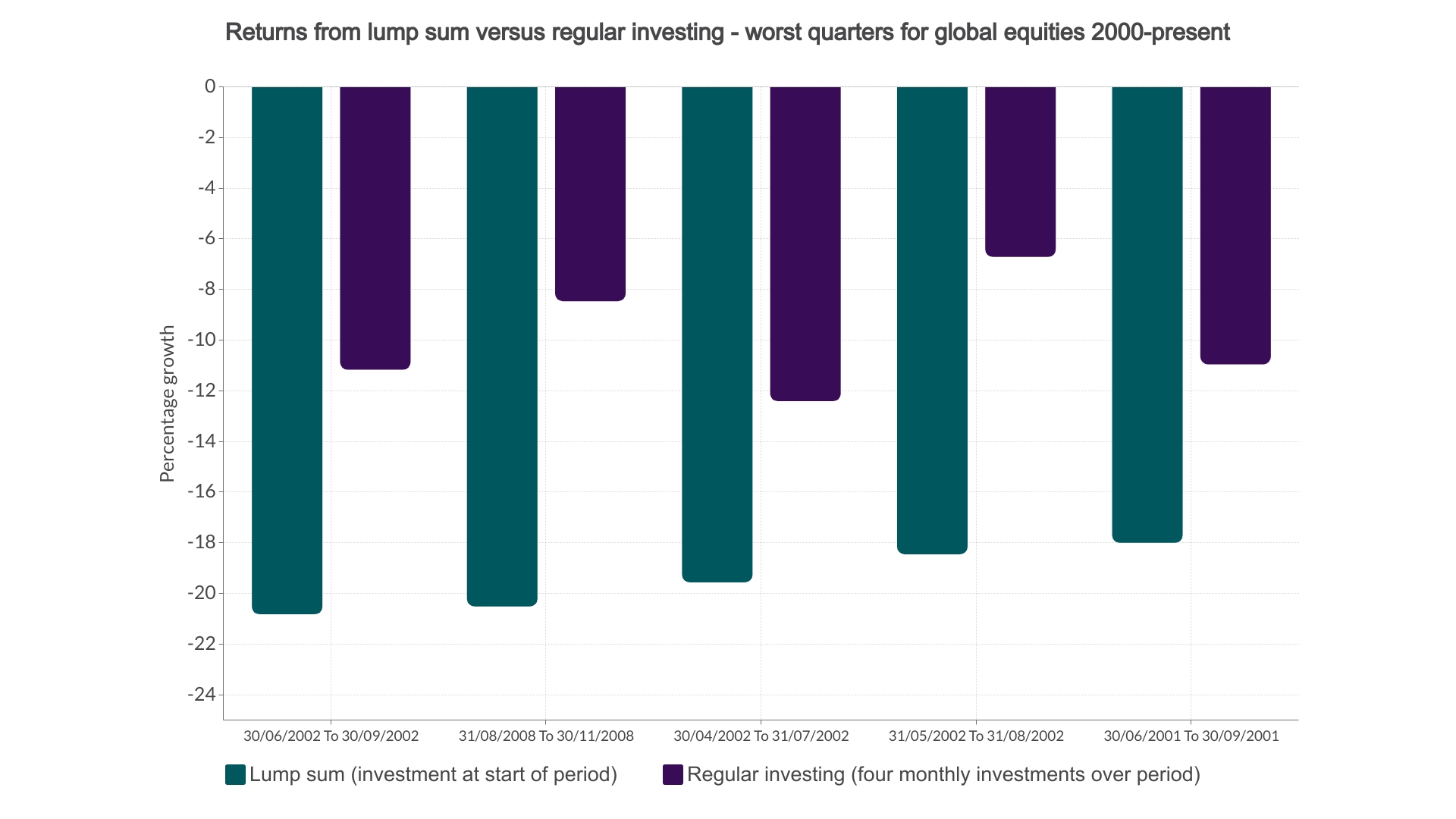

By saving regularly, you buy into markets at a variety of prices. Sometimes the market will be high and your monthly payment will buy fewer shares; sometimes it will be low and you will get more for your money. This is the concept of ‘pound-cost averaging’.

This approach reduces the problem of investing in the market just before a sell off. In the technology boom and bust of the late 1990s, for example, those who drip-fed money into tech stocks would only have had one or two months buying at the highest prices. They would have lost a little.

In contrast, those who got caught in the Dotcom excitement at its peak could have lost almost their entire holding. By buying in at different price points, an investor smooths out their average cost price.

The obvious question would be: why not buy in when the market is low? This would be ideal. But most people struggle to do it. The well-respected Dalbar survey in the US shows that investors consistently get a return lower than the market because they tend to trade in and out at the wrong time. Its recent report showed that in the first six months of 2021, investors underperformed the market by 2.11% through bad timing. (1.)

Source: Bestinvest / Lipper Investment Management, MSCI World Index, December 2021

Preventing emotional reactions

A problem for many investors is that emotion gets in the way of their decisions. They get swept along with the enthusiasm for a particular investment, often buying when there is maximum excitement. Equally, they may succumb to the prevailing gloom when markets sell off. This means they are buying when markets are high and selling when they are low, which is no way to grow wealth.

The trouble is that markets are unpredictable. For instance, they began to sell off sharply with the onset of the pandemic in February 2020, but sharply reversed course in late March. The pandemic was still at its height, lockdowns were widespread and there was no prospect of a vaccine. This shows how difficult it can be to predict the moment markets will turn.

Regular investing can stop you making kneejerk reactions, help you avoid falling for the flavour of the month, and ensure emotion doesn’t cloud your judgement.

Keep an eye on costs when investing regularly

Regular saving need not be more expensive than any other type of investment, but be careful. If, for example, there is a high dealing charge for every trade, it puts regular savers at a disadvantage. It is a good idea to make sure that costs aren’t taking a chunk out of your monthly contributions.

There will be those who enjoy the drama of financial markets. For everyone else, regular savings offer a means to escape the volatility and smooth returns over time. In general, they are a far better – and less stressful – way to grow wealth over time.

Remember all investments carry risk and you may get back less than invested.

Regular saving with Bestinvest

It’s easy to set up a monthly savings plan with any Bestinvest account. Choose from a Stocks & Shares ISA, Junior ISA, SIPP or Investment Account and start benefiting from our wide investment choice and expert insights.

This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers.

Source

1. Cision PR Newswire, Dalbar Survey, Investors Feel Latent Effects from their 2020 Behavior, August 2021